How to calculate total expenses

Introduction:

Calculating total expenses is essential for managing a household, business, or personal finances. Keeping track of all your expenditures can help you make better decisions and plan your budget effectively. This article will provide step-by-step guidance on how to calculate total expenses using a straightforward method that can be applied in any situation.

Steps to Calculate Total Expenses:

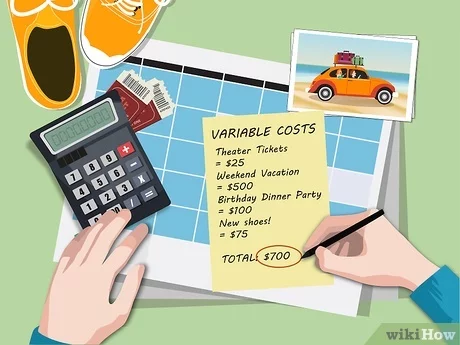

1. Identify all expenses: The first step to calculating total expenses is to make a list of all the costs incurred during a specific period, such as a month or year. Include recurring expenses like rent, utility bills, insurance premiums, and loan repayments. Also, take note of variable expenses like food, entertainment, transportation, and unexpected one-time costs (e.g., medical bills, gifts).

2. Categorize your expenses: Once you have listed all your expenses, categorize them into distinct groups such as housing, utilities, groceries, and so on. This will help you analyze your spending habits more effectively.

3. Convert diverse timeframes: Ensure that all your expense data is represented within the same timeframe (weekly, monthly, or yearly). For instance, if you have calculated an expense weekly but want the total expenditure for the month – multiply the weekly amount by four.

4. Sum up the category totals: Add up all the individual costs within each category. By doing this, you will get the total expense for each group during your chosen time period.

5. Calculate the overall total expense: Finally, add together all the category totals to arrive at your overall total expense for the chosen timeframe.

Monitoring Your Expenses:

Regularly tracking and assessing your total expenses can help you identify potential areas for savings or adjustments in how you allocate funds. Here are some tips for monitoring your spending habits:

1. Create a budget: A well-structured budget allows you to compare estimated and actual expenditure more accurately so that you can make informed decisions about your finances.

2. Use budgeting apps: Numerous budgeting tools can help you stay organized, track your expenses on the go, and provide valuable insights into your spending habits.

3. Schedule periodic reviews: Regularly evaluate your expenses to identify patterns or potential issues – monthly, quarterly, or yearly expense reviews can be beneficial.

4. Set realistic goals: Identify areas where you can cut down on expenses or reallocate funds to higher priority needs. Set achievable targets and monitor your progress over time.

Conclusion:

Calculating total expenses is a vital aspect of maintaining control over your financial life. By carefully tracking all costs and periodically reviewing them, you can make better decisions about allocating funds and meeting your financial goals. Remember to evaluate your total expenses regularly to maintain a strong financial footing.