How to calculate moic

Introduction:

The Multiple of Invested Capital (MOIC) is a financial metric that evaluates the return on investment for private equity and venture capital investments. It serves as an indicator of the efficiency and productivity of a particular investment by comparing the current or exit value to the initial amount invested. This article will guide you through the process of calculating MOIC, providing deeper insights into your investments’ performance.

1. Gather Relevant Data

To calculate MOIC, you’ll need two primary pieces of information:

– The initial investment amount (also known as cost basis or invested capital)

– The current or exit value of the investment (also referred to as realized or unrealized value)

2. Understand the MOIC Formula

The formula for calculating MOIC is relatively straightforward:

MOIC = Current/Exit Value ÷ Initial Investment Amount

Simply divide the current or exit value by the initial investment amount to calculate your MOIC.

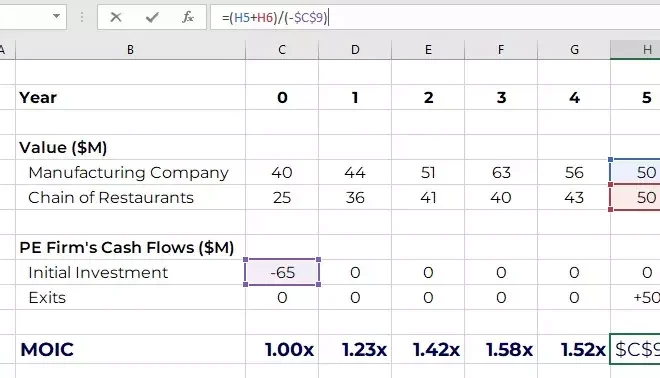

3. Calculate MOIC with an Example

Suppose you invested $1 million in a startup company. After five years, the value of your shares has increased to $5 million due to business growth and market demand.

Using the formula above, the calculation would be as follows:

MOIC = $5,000,000 ÷ $1,000,000 = 5

This translates to a 5x return on your original investment. In other words, you have earned five times more than your initial investment over five years.

4. Interpretation of MOIC

A higher MOIC indicates better-performing investments and may signify a strong return on investment (ROI). However, it’s essential to keep in mind that MOIC does not capture time as a variable and, thus, cannot provide insights into annualized returns without factoring in how long you’ve held your investment.

While relying on just one financial indication may not provide adequate insight into investment performance, MOIC can serve as a helpful supplement when used in conjunction with other metrics like the Internal Rate of Return (IRR) and Cash-on-Cash Return.

Conclusion:

Understanding how to calculate MOIC is beneficial for investors who want to measure the performance of their investments in private equity and venture capital. By comparing current or exit values against the initial investment amount, you can assess your investments’ efficiency and make relevant adjustments to your portfolio strategy accordingly. Remember, though, MOIC is just one of many metrics to consider when evaluating your overall investment performance.