How to calculate the quick ratio

In the world of business and finance, the quick ratio is a widely used financial measurement to gauge a company’s ability to meet its short-term financial obligations. Also known as the acid-test ratio or the liquid ratio, this tool provides insight into a company’s liquidity by demonstrating how well-positioned it is to cover its current liabilities without relying on selling inventory. This article will serve as a comprehensive guide on how to calculate the quick ratio.

Understanding the Quick Ratio

Before we dive into the formula and process for calculating the quick ratio, it is important to understand why this metric is so significant for businesses. The quick ratio measures a company’s accessibility to highly liquid assets—such as cash and marketable securities—that can be readily converted to cash in order to pay off current liabilities. In essence, this metric tells investors, creditors, and management if a company has sufficient resources available to avoid a potential liquidity crisis.

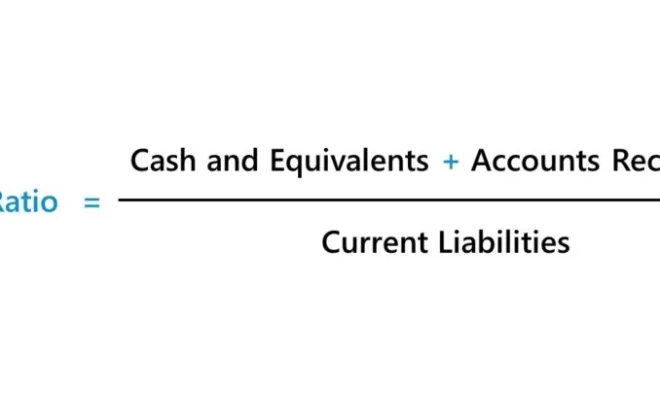

The Formula for Calculating the Quick Ratio

The quick ratio is calculated using the following formula:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

There are three components to this formula:

1. Current Assets: These are short-term assets expected to be realized within one year or one operating cycle, whichever is longer. Examples include cash, accounts receivable, short-term investments, and prepaid expenses.

2. Inventory: This represents purchased products or manufactured goods that are not yet sold and are still held by the company. Since inventory may take time to sell or may not convert into cash quickly enough, this component needs to be subtracted from current assets when calculating the quick ratio.

3. Current Liabilities: These are short-term debts or obligations that need to be paid within one year or one operating cycle, whichever is longer. Examples include accounts payable, short-term debt, accrued liabilities, and taxes payable.

Steps in Calculating the Quick Ratio

To calculate the quick ratio, follow these steps:

1. Identify the relevant financial statement of the company, typically the balance sheet.

2. Locate the values of current assets, inventory, and current liabilities from the financial statement.

3. Subtract inventory from the current assets.

4. Divide the result obtained in step 3 by current liabilities.

Using an Example

Let’s assume Company ABC has the following financial data:

– Current Assets: $150,000

– Inventory: $50,000

– Current Liabilities: $100,000

Using the quick ratio formula:

Quick Ratio = ($150,000 – $50,000) / $100,000

Quick Ratio = $100,000 / $100,000

Quick Ratio = 1

Company ABC has a quick ratio of 1, which indicates that it has enough liquid assets to cover its short-term debt obligations.

In conclusion, calculating the quick ratio is a simple yet essential process for businesses to understand their financial position in terms of liquidity. The results can help make informed decisions about investing in or lending to a company and can also assist management in identifying potential risks associated with its short-term obligations.