How to calculate cost of goods sold

In this article, we will discuss how to calculate the cost of goods sold (COGS) for your business. This calculation is crucial in determining a company’s gross profit margin and overall financial health.

1. Introduction to Cost of Goods Sold

The cost of goods sold represents the direct expenses a company incurs while producing or purchasing and selling products. It includes the cost of raw materials, labor, and other manufacturing overhead costs. By calculating COGS, you can determine the profitability of your product offerings and make informed decisions related to pricing and inventory management.

2. Components of COGS

The cost of goods sold comprises three main components: direct materials, direct labor, and manufacturing overheads.

– Direct Materials: These are the raw materials used in producing your products.

– Direct Labor: This includes wages and salaries paid to employees directly involved in the production process.

– Manufacturing Overhead: These are indirect costs associated with production, such as utilities, rent, and equipment depreciation.

3. Calculating COGS

You can calculate COGS using two approaches:

a) Periodic Inventory System:

With this method, you’ll need beginning inventory value, purchases made during the period, and ending inventory value.

COGS = Beginning Inventory + Purchases – Ending Inventory

b) Perpetual Inventory System:

In this system, you track your inventory continuously by updating it after every sale and purchase happens.

COGS = (Unit Price x Quantity Sold) + Beginning Inventory Costs

4. Example Calculation

Assume a company has the following data:

– Beginning Inventory Value: $10,000

– Purchase Value: $6,000

– Ending Inventory Value: $5,000

Using the periodic inventory system formula:

COGS = $10,000 (Beginning Inventory) + $6,000 (Purchases) – $5,000 (Ending Inventory)

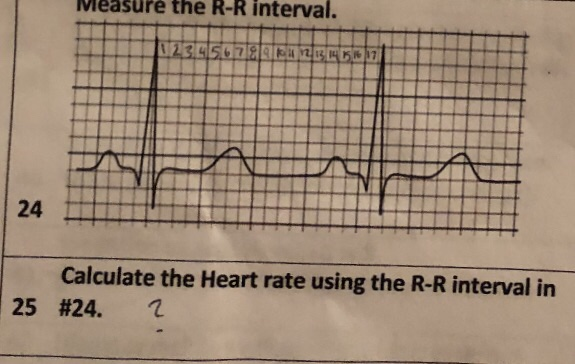

COGS = $11,000

5. Importance of COGS for Business

Calculating COGS is essential in understanding your company’s profitability. It helps determine the gross profit margin that indicates the percentage of revenue left after covering the production costs. A high gross profit margin means that your business has more money to cover its operating expenses and generate profits.

In conclusion, calculating the cost of goods sold is an essential financial metric for any business. It allows you to track your product’s profitability, set pricing strategies, and manage inventory effectively. By understanding your COGS, you can make well-informed decisions that lead to increased financial success for your company.