What Is the Statement of Shareholders’ Equity?

An essential component of a company’s financial statement, the Statement of Shareholders’ Equity, also known as the Statement of Stockholders’ Equity or Equity Statement, details the changes in a company’s equity over a specific accounting period. This financial report is crucial for investors as it shows how a company creates value and manages its equity.

Understanding the Statement of Shareholders’ Equity

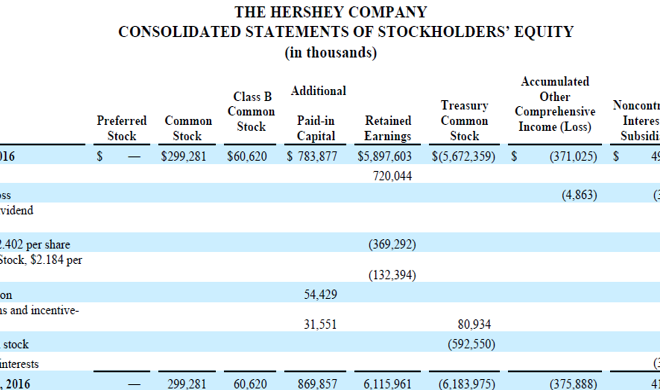

The Statement of Shareholders’ Equity is typically divided into several sections and includes the following components:

1. Common Stock: This section represents the total value of shares issued by a company. It provides an overview of how much equity capital the business has raised through issuing common stocks.

2. Preferred Stock: If a company has preferred stocks, this section shows the total value of preferred stocks issued. Preferred stockholders generally receive dividend payments before common stockholders.

3. Retained Earnings: Accumulated net income that has not been distributed as dividends is recorded in this section. Retained earnings demonstrate how much profit the company has reinvested in its operations.

4. Treasury Stock: Some companies repurchase their own shares to limit the number of outstanding shares and increase their value, which results in treasury stock. This section shows any changes in treasury stock during the accounting period.

5. Additional Paid-in Capital (APIC): APIC represents the excess amount received from selling shares above their par value. Any changes in APIC are recorded in this section.

6. Accumulated Other Comprehensive Income (AOCI): AOCI records any unrealized gains or losses on investments, currency translations, or pension plan adjustments that have not yet impacted net income.

Calculating Shareholders’ Equity

The calculation for Shareholders’ Equity is straightforward by using the following formula:

Shareholders’ Equity = Total Assets – Total Liabilities

This formula helps determine a company’s net worth, showing how much would remain for shareholders after all liabilities were paid off.

Importance of the Statement of Shareholders’ Equity

The report plays a vital role in understanding a company’s financial health for several reasons:

1. Value Creation: The statement highlights how well a company is generating value for its shareholders. This assessment becomes more evident when analyzing equity changes over time.

2. Investment Decisions: Investors analyze the statement to identify trends, which in turn can directly affect their investment decisions.

3. Company Performance: For management and investors, the statement serves as an indicator of company performance. It demonstrates how efficiently a company uses its equity capital to drive growth and profitability.

4. Dividend Policy: The Statement of Shareholders’ Equity allows investors to evaluate a company’s dividend policy, revealing whether it consistently pays dividends or retains earnings for reinvestment.

In conclusion, the Statement of Shareholders’ Equity is a critical financial report that showcases how a company manages its equity to create value for shareholders. Investors and analysts use this statement to evaluate investment potential and assess the overall financial strength of a business.