What Are Convertible Bonds?

Convertible bonds are a unique type of financial investment that combines the features of both traditional bonds and stocks. They provide investors with the potential for capital appreciation while still offering a fixed income component. As such, convertible bonds offer both security and growth opportunities, making them an appealing option for many investors.

What Makes Convertible Bonds Different?

The key difference between traditional bonds and convertible bonds is the conversion feature. This feature gives bondholders the right to convert their bonds into a predetermined number of shares of the issuing company’s stock at a specific price, known as the conversion price. This conversion can typically occur at any time during the life of the bond, but some may have restrictions or specific windows for conversion.

Advantages of Convertible Bonds for Investors

1. Income and Growth: Convertible bonds provide investors with regular interest payments like traditional bonds, while also having the potential to share in the capital appreciation of the company through their conversion feature.

2. Diversification: By investing in both fixed income assets (bonds) and equities (shares), convertible bonds help investors diversify their portfolios and reduce overall risk.

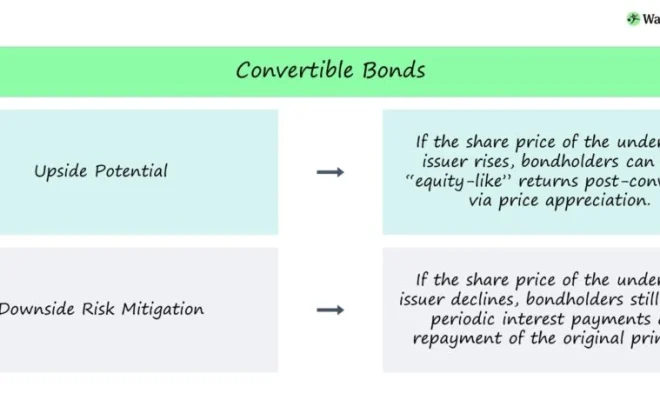

3. Downside Protection: If the company’s stock prices decline below or near the conversion price, convertible bond prices generally remain stable due to their fixed-income component, which provides a measure of protection against poor stock performance.

4. Participation in Upside Potential: If a company’s stock price rises above the conversion price, bondholders can choose to convert their bonds into shares and take advantage of higher stock prices, potentially realizing capital gains.

5. Preferential Treatment: In case of bankruptcy or liquidation, convertible bondholders usually have priority over common shareholders when assets are being distributed.

Advantages for Issuing Companies

1. Lower Interest Rates: Companies may issue convertible bonds at lower interest rates compared to traditional bonds, as investors may accept a lower coupon rate in exchange for potential capital appreciation.

2. Reduced Equity Dilution: Convertible bonds help companies raise capital without immediately diluting outstanding shares, as bonds are only converted into stock when the bondholder opts for conversion.

3. Attract Diverse Investors: Issuing convertible bonds allows companies to attract a broader range of investors who may have varied risk volatility preferences, appealing to both fixed income and equity-oriented investors.

Conclusion

Convertible bonds offer a unique investment opportunity with benefits for both investors and issuers. They provide an attractive mix of income generation, potential capital appreciation, diversification, and protection against downside risks while allowing companies to raise funds at lower costs and appeal to a wider range of investors. Nevertheless, like any investment instrument, investors should carefully consider all factors before adding convertible bonds to their portfolios.