How to Start a Finance Company

Introduction

Starting a finance company can be a profitable venture as it presents numerous opportunities for growth and success. The finance sector is one of the cornerstones of the modern economy, offering various financial services like loans, insurance, and investments to individuals and businesses. This article will guide you through the steps required to start your finance company.

1. Determine Your Niche

Before starting your finance company, you must identify the specific niche you want to focus on within the vast financial industry. Some common niches include personal loans, equipment financing, commercial lending, factoring, and leasing. The selected niche will determine your business model and target market.

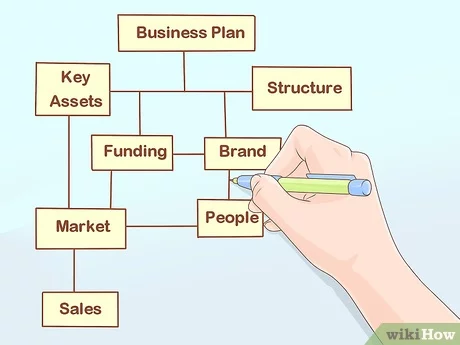

2. Develop a Business Plan

A comprehensive business plan is essential for any startup. It should outline your company’s missions, vision, target market, competition analysis, marketing strategies, financial projections, and risk assessment. A well-crafted plan will not only serve as a blueprint for your tasks but also aid in seeking funding from investors or banks.

3. Register Your Business

Legal compliance is crucial when establishing a finance company. You will need to register with appropriate authorities to gain credibility and protection under the law. You can choose from multiple types of legal structures like sole proprietorship, partnership, LLC (Limited Liability Company), or corporation.

4. Obtain Necessary Licenses and Permits

Starting a finance company involves acquiring licenses and permits, which vary depending on your location and chosen niche. Generally, a finance company needs to have state or federal licenses to operate legally in most countries.

5. Build Your Team

Hiring competent professionals is vital for the success of your finance company. Your team should include experienced individuals with expertise in managing finances, sales personnel skilled in closing deals with clients, and support staff that handles client communications.

6. Secure Funding

Initial capital is necessary for starting your business operations and covering initial expenses like rent, equipment, and marketing efforts. Options for funding include personal savings, bank loans, crowdfunding, or seeking investment from venture capitalists or angel investors.

7. Set Up Internal Controls

Financial integrity is crucial for a finance company. Establish a strong system of internal controls to ensure the proper handling of finances, avoid fraud, and maintain compliance with regulatory requirements. This may include appointing an internal auditor, implementing software systems for financial management, and having clear policies for employees.

8. Implement Marketing Strategies

Effective marketing will help you reach potential clients and create awareness about your services. Some marketing strategies to consider are online advertising, building a website, content marketing, search engine optimization (SEO), social media, and public relations.

9. Monitor Your Finances and Performance Metrics

Tracking your company’s financial performance is vital in determining areas that need improvements or adjustments. This may include monitoring cash flow, profitability ratios, customer acquisition costs, loan default rates, and overhead expenses.

10. Enhance Your Product Offerings

As your finance company grows over time and gains loyal customers, consider expanding your product portfolio to cater to diverse client needs better. This may involve incorporating insurance products or introducing different types of loans into the services provided by your company.

Conclusion

Starting a finance company requires careful planning, legal compliance, adequate funding, strategic marketing efforts, and dedicated customer service. By following these steps, you can build a successful finance company that thrives in the ever-evolving financial sector landscape.