How to Open a Brokerage Account

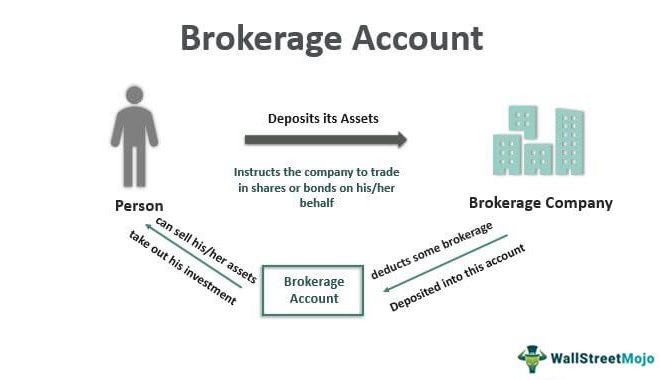

Opening a brokerage account is an essential step in starting your investment journey. A brokerage account allows you to buy and sell stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other financial instruments. Here’s a step-by-step guide on how to open a brokerage account:

1. Research and select a brokerage firm: Before opening an account, research different brokerage firms to find one that suits your needs. Factors to consider include reputation, fees, available investment options, customer service, user-friendliness of their platform, and the minimum deposit required.

2. Decide between a cash or margin account: A cash account requires that you have enough funds in the account to cover any trades before executing them. A margin account allows you to borrow money from the broker to invest – offering the potential for higher returns but also increasing risk.

3. Gather required documentation: To open a brokerage account, you’ll need to provide personal information such as your name, address, Social Security number or Tax ID number, and employer information. You may also need to provide proof of identity and address in some cases.

4. Complete application process: Visit the chosen brokerage firm’s website and start the application process. This typically involves filling out an online form with your personal details, financial situation, and investment goals. You may also need to answer questions about your investment experience and risk tolerance.

5. Fund your account: After your application is approved, fund your account via bank transfer (ACH), wire transfer, check deposit, or by transferring assets from another brokerage firm (if applicable). Many brokers require a minimum initial deposit, so make sure you meet their requirements.

6. Create a trading password: Most brokerage firms require clients to set up a trading password for added security when placing trades. Choose a secure password that’s not easy for others to guess.

7. Get familiar with the platform: Take some time to learn how the brokerage platform works, exploring features such as market research, charting tools, trade execution, and account management.

8. Begin investing: Once your account is set up and funded, you can start buying and selling investments. Be sure to develop a robust investment strategy that aligns with your financial goals and risk tolerance.

In summary, opening a brokerage account involves researching brokerage firms, selecting an account type, providing personal information, funding the account, and familiarizing yourself with the trading platform. As you gain confidence in your investing skills, stay informed about market trends and always be prepared to adjust your investment strategy accordingly.