How to calculate contribution margin ratio

In the world of business and finance, understanding the contribution margin ratio is crucial to maximizing profits and ensuring the financial health of an organization. The contribution margin ratio, also known as the profit-volume ratio, measures the percentage of each sale that contributes to covering fixed costs and generating profit. In this article, we will explore the significance of the contribution margin ratio and discuss the steps to calculate it effectively.

Understanding the Contribution Margin Ratio

Before diving into the calculation process, it’s essential to grasp the concept of contribution margin ratio. This metric helps a company determine how much money they make on each unit sold after accounting for variable costs such as raw materials, labor, and utilities. It is a crucial performance indicator that enables businesses to gauge their profitability and make informed decisions on pricing, production levels, and expansion opportunities.

Steps to Calculate the Contribution Margin Ratio

Here’s a step-by-step guide to calculating your company’s contribution margin ratio:

1. Identify Revenue: Begin by understanding your total revenue from sales. Total revenue refers to all income generated through sales activities before considering expenses.

2. Determine Variable Costs: Variable costs are expenses that fluctuate with changes in production levels or sales volumes. Common examples include raw materials used in manufacturing, packaging materials, direct labor costs, and shipping expenses.

3. Calculate Contribution Margin: To arrive at your company’s contribution margin (CM), subtract total variable costs from total revenue. The resulting value represents how much money remains after covering all variable costs.

CM = Total Revenue – Total Variable Costs

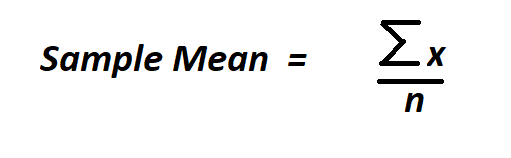

4. Compute Contribution Margin per Unit: To determine how much each unit contributes to fixed costs and profit generation, divide your overall contribution margin by the number of units sold.

CM per unit = CM / Units Sold

5. Identify Fixed Costs: Fixed costs are business expenses that remain constant regardless of production volume or sales activity. Examples include rent payments, insurance premiums, and employee salaries.

6. Calculate CM Ratio: The final step involves dividing your contribution margin per unit by the unit-selling price. The result, expressed as a percentage, represents your company’s contribution margin ratio.

CM Ratio = (Contribution Margin per Unit / Unit-Selling Price) x 100

Analyzing the Results

A higher contribution margin ratio is generally more favorable, indicating that a significant portion of each sale contributes to covering fixed costs and earning profits. However, it is also essential to consider other factors such as market conditions, competition, and pricing strategies when interpreting the results.

In conclusion, calculating the contribution margin ratio is vital to understanding the profitability and financial viability of your business operations. By following the steps outlined in this guide, you’ll be well-equipped to make data-driven decisions that maximize your company’s profits and ensure long-term growth.