How to Calculate a Lump Sum Pension Payout

Introduction

A lump sum pension payout is a single, large payment received from your pension plan administrator instead of receiving smaller monthly payments over time. This can be an attractive option for some retirees, as it allows them to have full control over their money and use it for whatever they choose. In this article, we’ll discuss the process of calculating the value of a lump sum pension payout and the factors that need to be taken into consideration.

Step 1: Gather Necessary Information

To calculate your lump sum pension payout, you will first need to gather some key information:

1. The amount of your monthly pension payment

2. Your current age

3. Your estimated life expectancy

4. The annual inflation rate

5. The applicable discount rate or interest rate

You can find most of this information on your latest pension statements or by contacting your pension plan administrator.

Step 2: Estimate the Total Value of Your Monthly Payments

Once you have gathered all necessary information, start the calculation by estimating the total value of your future monthly payments.

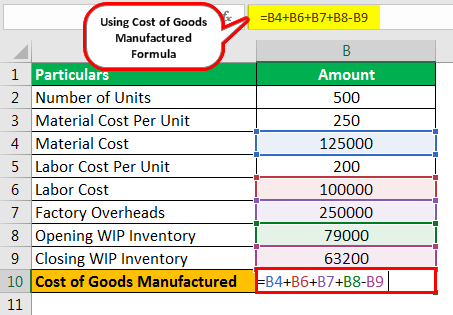

This can be done using a process called “present value” calculation. Using the following formula:

PV = P * [1 – (1 + r)^(-n)] / r

Where:

PV = Present Value (the total value of all future payments)

P = Monthly pension payment

r = Discount rate (expressed as a decimal)

n = Number of future payments (estimated life expectancy in years, multiplied by 12)

Plug in the values from Step 1 into this formula to get an estimate of the present value of your future pension payments.

Step 3: Adjust for Inflation

Inflation erodes the purchasing power over time, so it is essential to adjust your payout calculation for inflation to understand the true value of today’s dollars. To adjust for inflation, you need to estimate how much inflation will impact your future payments. Generally, you can use the historical average inflation rate as a rough guideline (for example, 3%).

Using the same formula from Step 2, and replacing r with the inflation rate to recalculate the present value adjusted for inflation.

Step 4: Combine Present Values

Combine the present values obtained in Steps 2 and 3 to arrive at an estimate of the lump sum payout. This effectively accounts for both the discount rate (the time value of money) and the inflation rate. The result will provide you with a lump sum value in today’s dollars that is equivalent to the total value of your monthly pension payments over your lifetime.

Conclusion

Calculating a lump sum pension payout is an essential step in determining whether taking a lump sum is right for you. By understanding the factors that influence these calculations and considering both financial and personal circumstances, retirees can make an informed decision about their pension distributions. It is also recommended to consult with a financial professional to explore various scenarios and ensure that all possible options have been thoroughly evaluated.