How to Buy Oil Wells

Introduction

Investing in oil wells can be a lucrative way to diversify your portfolio and capitalize on the ever-present global demand for energy resources. Buying an oil well requires research, due diligence, and understanding of various factors that influence the profitability and long-term sustainability of this investment. In this article, we will outline a step-by-step approach to guide you through the process of buying an oil well.

Step 1: Conduct thorough research

Research is critical when considering investing in the oil industry. Familiarize yourself with the basics of the oil market, including supply and demand trends, geopolitical factors, technological advancements, and environmental concerns. Understand how these variables affect oil prices and consequently, your profits. Research different types of oil wells – production, exploration, or royalty interest ownership – and determine which option best suits your risk tolerance and investment goals.

Step 2: Identify potential opportunities

Once you have developed a foundational understanding of the industry, begin searching for potential opportunities. There are various ways to identify oil wells for sale:

– Online platforms: Browse various websites that list oil wells for sale.

– Industry publications: Check out specialized publications in the oil sector which may feature news or advertisements about available opportunities.

– Networking events: Attend industry conferences or events to meet professionals who could connect you with suitable prospects.

Step 3: Evaluate the location and infrastructure

The location of an oil well plays a significant role in its profitability. Analyze geographical factors like terrain, accessibility, climate conditions, local regulations, and proximity to other infrastructures (such as pipelines). Evaluate existing infrastructure around the prospective well; consider site conditions, equipment efficiency, extraction capabilities, transport logistics, storage facilities, environmental impact assessment reports (if any), permit status among other factors.

Step 4: Assess financial viability

Analyze a wide range of financial parameters for the prospective investment:

– Estimated reserves: Determine the quantity and quality of recoverable oil.

– Production rate: Evaluate the current production rate and anticipate future trends.

– Revenue and costs: Review past financial records, including revenue from oil sales and operating expenses.

– Taxation and royalties: Understand fiscal regulations surrounding oil production.

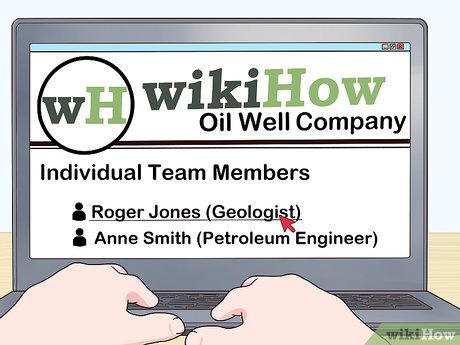

Step 5: Conduct a thorough due diligence

Engage a team of professionals, such as geologists, engineers, or legal experts, to perform comprehensive due diligence on the selected oil well. Verify land ownership, lease agreements, environmental impact assessment, licensing and permits with regulatory authorities. Physical inspection of the site should be carried out by experienced personnel; this is critical in detecting potential safety hazards or other operational shortcomings.

Step 6: Negotiate and close the deal

Once you are satisfied with your research findings, engage in negotiations. Reflect on the financial valuation and specific terms of payment that you assessed earlier to facilitate constructive discussions. Keep an eye on market trends as they may affect oil prices during these talks; consider involving a broker – an intermediary can fuel negotiations in a way that satisfies both parties. Upon reaching an agreement, execute legal documents to finalize the transactional aspect of your purchase.

Conclusion

Investing in oil wells can yield substantial returns; however, it is not without its risks. By conducting thorough research, identifying opportunities in promising locations, carefully assessing financial viability, engaging due diligence support from industry experts, and practicing strong negotiation skills, you increase the likelihood of securing a fruitful investment for years to come.