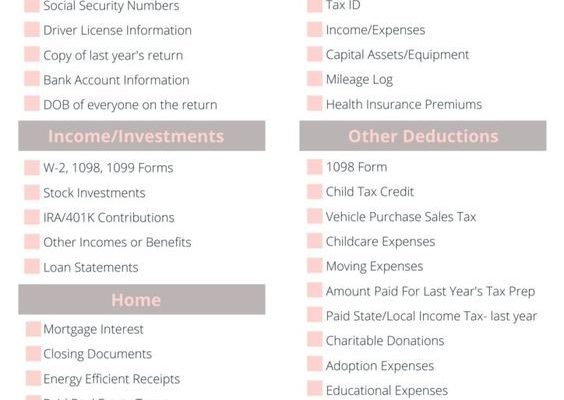

Get a Head Start on Your Taxes: Here Are the Documents You Need to Collect Before Filing

As tax season approaches, it’s crucial to start assembling the necessary documents to ensure a smooth and accurate filing process. Collecting these documents early can reduce stress and possibly improve your chances of maximizing your returns or minimizing your obligations.

Here’s what you need:

1. Personal Information:

– Social Security numbers and dates of birth for yourself, your spouse, and dependents.

2. Income Statements:

– W-2 forms from all employers.

– 1099 forms for freelance income, dividends, interest, retirement distributions, or government payments.

– Statements reporting miscellaneous income, such as rent, royalties, or jury duty.

– Records of other forms of income such as alimony received or the sale of property.

3. Tax Deductions and Credit Documents:

– Property tax bills or mortgage interest statements (Form 1098).

– Receipts for educational expenses, such as tuition or textbooks.

– Records of medical expenses that were not reimbursed.

– Proof of charitable donations (monetary and non-monetary).

4. Additional Tax Forms and Schedules:

– Schedule A for itemized deductions.

– Schedule C for profit or loss from business.

– Schedule D for capital gains and losses.

5. Health Insurance Verification:

– Form 1095-A if you enrolled in insurance coverage through the Marketplace.

– Records of any health insurance coverage exemptions received.

6. Contributions to Retirement Accounts:

– Traditional IRAs contributions to determine potential deductibility.

– Statements from Roth IRA accounts if there’s a qualifying withdrawal.

7. Information on Tax Payments:

– Records of estimated tax payments made during the year (federal/state/local).

Gathering these documents in advance can be incredibly beneficial. You’re less likely to overlook potential deductions or credits that could be crucial to your filing. Plus, with everything at hand, you can provide your tax preparer with all the information they need or proceed confidently if you’re using tax software. Remember that deadlines matter; give yourself ample time to request copies of lost documents and reach out to institutions if necessary.

Be proactive; getting ahead means less scrambling as the deadline looms closer. By collecting these documents now, you’ll be setting yourself up for success come tax filing season.