Dividend Reinvestment: Should I Do It?

Introduction

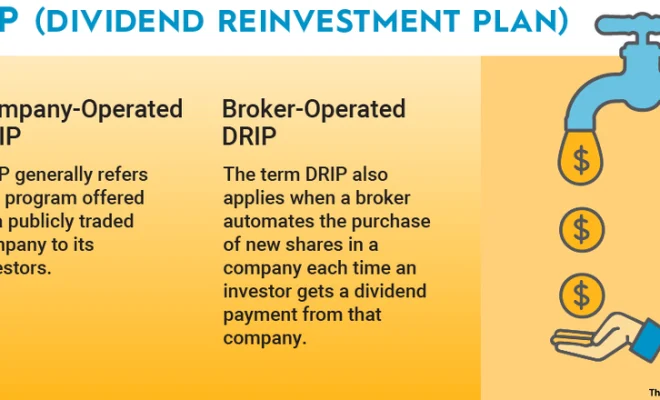

Dividend reinvestment is an investment strategy that involves using your dividends to buy more shares of the company paying the dividends. When a company declares dividends, shareholders receive a cash payment proportional to the number of shares they hold. With dividend reinvestment, this cash is used to buy additional shares instead of being paid out directly. The primary question for investors, then, is whether or not they should consider opting for dividend reinvestment. This article explores the pros and cons of dividend reinvestment and helps you determine if it’s a suitable approach for your investments.

Advantages of Dividend Reinvestment

1. Compounding Growth

One of the most notable benefits of dividend reinvestment is its ability to supercharge compounding for long-term investors. As you acquire more shares through reinvested dividends, any future dividends will be calculated based on an increased number of shares in your portfolio. This effect results in exponential growth over time, potentially surpassing what you could achieve with regular investments.

2. Automated Investing

Dividend reinvestment is an automatic process that does not require active involvement from investors. This automated approach allows you to grow your wealth while remaining hands-off, saving time and effort.

3. Dollar-Cost Averaging

By consistently reinvesting your dividends, you practice dollar-cost averaging—buying more shares when prices are low and fewer when prices are high—without incurring additional transaction costs or fees typically associated with frequent trading.

Disadvantages of Dividend Reinvestment

1. Limited Liquidity

When you engage in dividend reinvestment, your cash return on investment becomes limited, as the received dividends are used to buy more shares rather than being paid out as liquid assets. If your income requirements necessitate regular cash influxes from your investments, dividend reinvestment may prove unsuitable.

2. Tax Implications

Even if the received dividends are reinvested rather than cashed out, they are still taxable as regular income. Keep this in mind before choosing dividend reinvestment, as taxes can potentially erode some of your gains.

3. Over-concentration in a Single Stock

Automatic dividend reinvestment might lead to an over-concentration in a single stock or sector if you don’t maintain a balanced and diversified portfolio. This exposure may increase risk and hamper long-term returns.

Should You Opt for Dividend Reinvestment?

Dividend reinvestment is an attractive option for investors with a long-term perspective who seek to grow their wealth without actively managing their portfolios. However, those who require regular cash payouts or wish to minimize their tax burden should carefully assess whether dividend reinvestment is the right choice for them.

To determine if dividend reinvestment aligns with your financial goals, consult with a financial advisor and consider factors such as your investment time horizon, income requirements, and overall investment strategy. By doing so, you can make an informed decision about whether dividend reinvestment suits your specific circumstances.