2024 Tax Changes: Your Paycheck Might Get Bigger Next Year. Here’s Why

As the calendar turns to 2024, taxpayers across the United States can anticipate a few changes that may positively affect their paychecks. Understanding these changes is critical to ensuring that individuals and families can plan accordingly for their financial futures.

One of the notable changes for the 2024 fiscal year involves an adjustment to the income tax brackets. The Internal Revenue Service (IRS) typically adjusts these brackets annually for inflation, which means that taxpayers may fall into lower tax brackets, leading to less money being withheld from their paychecks and potentially larger take-home pay.

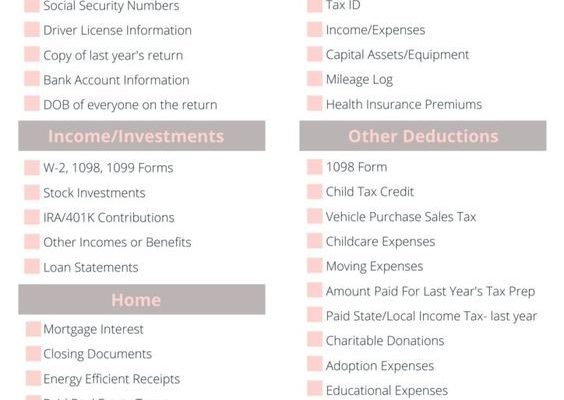

Additionally, taxpayers can expect an increase in the standard deduction. For single filers, the standard deduction could rise significantly, with greater hikes for married couples filing jointly. This increase allows individuals and families to deduct a more considerable amount from their income before calculating their taxable income, resulting in lower overall tax liability.

Another factor contributing to potentially bigger paychecks is the possibility of enhancements to certain tax credits. Tax credits such as the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are evaluated each year, and qualifying changes can result in increased benefits for eligible taxpayers. These expanded credits would directly decrease tax bills or increase refunds during filing, thereby boosting post-tax income throughout the year if taxpayers adjust their withholdings accordingly.

Furthermore, there will be modifications to retirement contribution limits. The IRS may raise the cap on 401(k), 403(b), and most 457 plans, which encourages higher pre-tax contributions that effectively reduce taxable income, leaving employees with more net pay after withholdings for taxes.

Lastly, another factor that could result in more substantial take-home pay is potential decreases in payroll taxes. While Social Security tax rates remain constant regardless of inflation, there’s always a chance of legislative changes that could temporarily lower payroll taxes or adjust the wage base to which Social Security taxes apply.

It’s imperative for individuals to consult with a financial advisor or a tax professional to understand how precisely these tax changes might affect their financial situation. Keeping informed and making strategic adjustments throughout the year can ensure taxpayers maximize their earnings and minimize their liabilities.

Overall, several tax changes on the horizon for 2024 could mean more money in American workers’ pockets. From adjusted income brackets and increased standard deductions to enhanced tax credits and retirement contributions – these shifts all point towards a lighter tax burden and potentially heftier paychecks for many taxpayers come next year.