When is the Best Time to Pay My Credit Card Bill? Canada

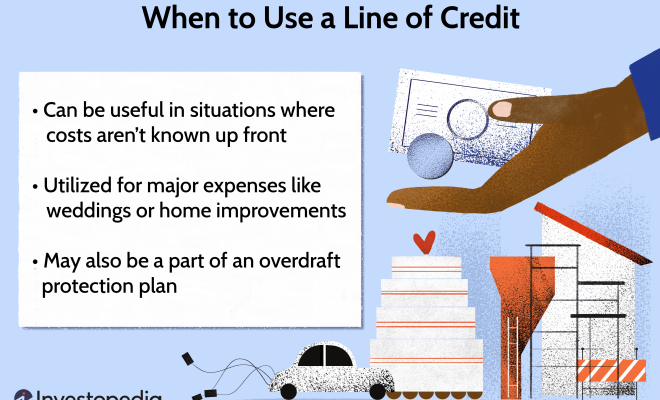

With credit cards being an essential financial tool in today’s world, managing their usage and bill payments efficiently is crucial. Finding the best time to pay your credit card bill ensures that you optimize your finances and stay on top of your debt. In Canada, timing your credit card payments properly can help improve your credit score, save you money, and keep you away from unnecessary stress.

1. The Grace Period: Understanding Its Importance

Typically, credit card issuers grant a grace period for new purchases (around 21 days). This interest-free window allows customers to pay off their entire outstanding balance without accruing any interest. To maximize the benefits of the grace period, it’s essential to pay off the entire balance within this timeframe; otherwise, finance charges will kick in.

2. Due Date: Making Timely Payments

The due date is a specific day of the month by which you need to make at least the minimum payment on your credit card account. Failure to do so could lead to late fees, increased interest rates, and a negative impact on your credit score. To ensure timely payments, set up a calendar reminder or enable autopay through your financial institution.

3. Reporting Date: Aligning Payments with Your Credit Utilization Ratio

Another key date to keep in mind is your credit card issuer’s reporting date – the day when they report your account activity to Canadian credit bureaus. If possible, make your payments before this date so that the updated information reflects on your credit report. This strategy can be especially helpful if you are trying to lower your credit utilization ratio – a significant factor in determining one’s overall credit score.

4. Multiple Payments Throughout the Month: A Smart Strategy

For those who are worried about high balances and maxed-out cards negatively affecting their credit score, making multiple smaller payments throughout the billing cycle can help. These micropayments can reduce your credit utilization and improve cash flow management.

In conclusion, understanding the different dates on your credit card account – such as the grace period, due date, and reporting date – can help you determine the best time for making payments. Adhering to these timelines, while considering multiple payments throughout the month, will ensure that you optimize your finances and maintain a healthy credit score.