What is Short-Selling?

Introduction:

Short-selling is a trading strategy employed by investors and traders in the financial markets. It involves selling an asset they do not currently own, with the intention of buying it back at a lower price to make a profit. This article explores the concept of short-selling, its mechanics, and potential risks associated with this practice.

Understanding Short-Selling:

In the financial markets, investors are often looking to make profits from price fluctuations. While some may ‘go long’ and buy assets hoping for their price to increase, others choose to engage in short-selling, speculating on price declines.

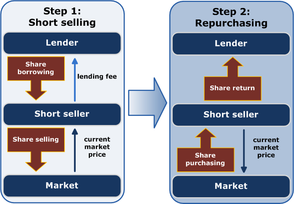

At its core, short-selling involves borrowing an asset (such as a stock) from someone else (typically a broker), selling it on the open market, and buying it back at a later time – ideally, at a lower price. The difference between the initial sale price and the repurchase price is the profit for the short-seller.

Mechanics of Short-Selling:

Here’s how short-selling works step by step:

1. The investor identifies an asset they believe will decrease in value.

2. They contact their broker to borrow the desired quantity of this asset.

3. The broker checks if there are sufficient shares available for lending.

4. The investor sells the borrowed shares/assets in the open market.

5. The asset’s price drops, as predicted by the investor.

6. The investor buys back the shares/assets at a lower price.

7. Borrowed assets are returned to the broker.

8. If there was a decrease in price, the difference between initial sale and repurchase price results in profit.

Risks Associated with Short-Selling:

While short-selling can potentially lead to profits during bearish market conditions, it’s essential for investors to understand that it carries significant risks:

1. Infinite potential losses: Unlike going long on an investment, wherein losses are limited to the original investment amount, short-selling exposes investors to potentially unlimited losses since an asset’s price can theoretically rise indefinitely.

2. Margin requirements: Short-selling often requires investors to maintain a margin account with their broker, ensuring they have enough funds to cover potential losses. Failure to meet these requirements can result in brokers invoking a ‘margin call,’ asking the investor to settle the balance or close their positions forcefully.

3. Regulatory risk: Financial authorities may impose restrictions on short-selling during periods of extreme market volatility or ban it altogether, impacting the ability of short-sellers to exit their positions.

4. Short squeezes: A rapid increase in an asset’s price due to heavy buying pressure (e.g., from other short-sellers attempting to cover their positions) can cause a ‘short squeeze.’ This scenario can lead to significant losses for those holding short positions.

Conclusion:

Short-selling is a trading strategy that allows investors to profit from assets’ declining prices in

the financial markets. However, it carries substantial risks and requires traders and investors to carefully consider these factors when employing this approach. Complete understanding, thorough research, and risk management are essential for improving the chances of success when venturing into short-selling.