What Is an Index Fund?

Introduction:

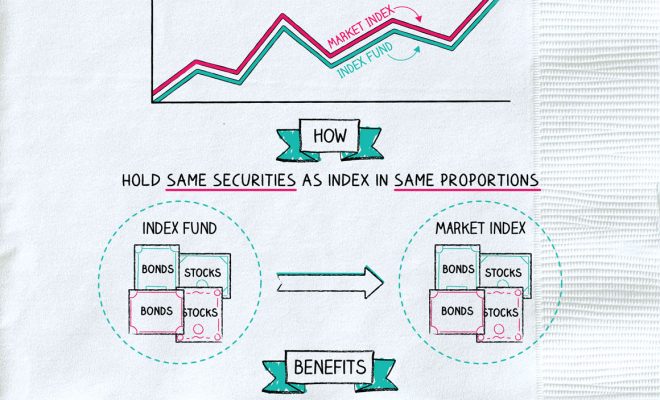

An index fund is a type of mutual fund or exchange-traded fund (ETF) designed to follow and replicate the performance of a specific market index. The market index can be based on various asset classes such as stocks, bonds, or commodities. By linking its investment strategy to a particular index, an index fund offers investors an affordable and efficient way to diversify their portfolio while reducing overall risk.

Components of an Index Fund:

1. Market Index: An index fund is built on a specific market index. Some widely recognized indices include the S&P 500, Dow Jones Industrial Average (DJIA), and Nasdaq Composite. These indices track the performance of a particular segment of the market – for example, large-cap stocks in the case of the S&P 500.

2. Passive Management: Index funds are passively managed, meaning they aim to match the benchmark index’s performance rather than outperform it through active stock picking or market timing by the fund manager. This results in lower management fees and operating costs compared to actively managed funds.

3. Diversification: An investment in an index fund offers exposure to a broad range of assets within the chosen index. This diversification helps to minimize risk by spreading investments across multiple securities.

4. Cost Efficiency: Due to passive management, index funds have significantly lower expense ratios compared to actively managed funds as there is no need for extensive research or portfolio analysis by a fund manager.

Benefits of Investing in Index Funds:

1. Consistent Returns: Over time, research has shown that index funds have outperformed many actively managed funds after accounting for fees and taxes.

2. Simplicity: Investors can benefit from a simple investment strategy without worrying about individual stock selection or timing the market.

3. Lower Costs: The absence of active management results in reduced expenses associated with trading, research, and management fees.

4. Access to Broad Market Exposure: Investing in an index fund can provide immediate exposure to a diverse range of securities across different industries and asset classes.

Potential Drawbacks:

1. Limited Upside Potential: Since index funds strive to match the market’s performance, the potential for market-beating returns is minimal.

2. Lack of Flexibility: Index funds are bound by the rules of the underlying index, which means they may hold on to poorly performing stocks or fail to capitalize on emerging opportunities.

Conclusion:

Index funds offer a simple, cost-efficient, and diversified investment strategy for investors looking to minimize risk and achieve consistent returns over time. While there may be limitations in terms of upside potential and flexibility, the benefits often outweigh these drawbacks for long-term investors seeking broad market exposure with lower costs.