What is a manufacturing company calculates cost of goods sold as follows

Introduction

A manufacturing company is an entity that produces goods for sale, utilizing resources such as labor, capital, and raw materials. One of the key financial metrics used to assess the efficiency and profitability of a manufacturing company is the cost of goods sold (COGS). This value represents the total cost incurred to produce and sell products during a specific period. Understanding how a manufacturing company calculates the cost of goods sold is crucial for investors, managers, and other stakeholders to evaluate the company’s performance.

Cost of Goods Sold Calculation

To calculate COGS in a manufacturing company, one must consider three primary components: beginning inventory, cost of goods manufactured (COGM), and ending inventory.

1. Beginning Inventory: This value represents the total worth of raw materials, work in progress, and finished goods that a company has in stock at the start of an accounting period. It serves as the initial base for COGS calculation.

2. Cost of Goods Manufactured (COGM): This component refers to the costs incurred by the company during the production process, including costs related to raw materials, labor, and overheads. Determining COGM consists of several steps:

a. Raw Material Costs: The initial cost is the price paid for raw materials needed to manufacture the products.

b. Labor Costs: These costs include wages and benefits paid to employees directly involved in production.

c. Manufacturing Overheads: Overhead costs are all indirect costs associated with production activities, such as factory rent, utilities, maintenance, and depreciation on machinery.

3. Ending Inventory: The ending inventory refers to the value of raw materials, work in progress, and finished products that remain unsold at the end of an accounting period. This value is subtracted from the sum of beginning inventory and COGM to obtain the final COGS.

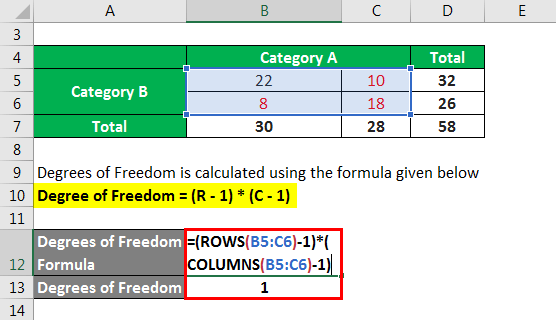

Formula for Cost of Goods Sold

Based on the components discussed, the formula for calculating COGS in a manufacturing company is:

COGS = Beginning Inventory + COGM – Ending Inventory

Conclusion

In summary, a manufacturing company calculates the cost of goods sold by incorporating beginning inventory, cost of goods manufactured, and ending inventory values. This financial metric is essential for stakeholders to assess the company’s efficiency and profitability. By understanding the COGS calculation process, decision-makers can identify areas of improvement and implement strategic measures to optimize the overall production process.