What Gold Type Is Best To Invest In In 2024?

Gold has always been a timeless investment, and as we head into 2024, many investors are asking: what gold type is best to invest in? When it comes to investing in gold, there are several options to consider, each with its own advantages and considerations.

Physical Gold Bullion

Investing in physical gold bullion is perhaps the traditional way of investing in gold. This includes buying gold bars, coins, or ingots. The main advantage is that you hold a tangible asset with intrinsic value. In 2024, with the potential for economic uncertainty and inflationary pressures, physical gold can act as a “safe haven” for investors seeking to preserve their wealth.

However, there are downsides, including storage and insurance costs, and the risk of theft. Moreover, the liquidity might be less when compared to other forms of gold investments as it requires finding a buyer for the physical product.

Gold ETFs (Exchange-Traded Funds)

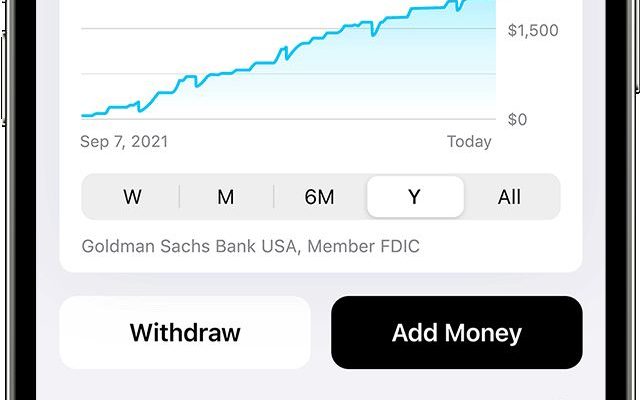

Gold ETFs allow investors to buy shares that mirror the price of gold without needing to hold any physical gold. This form of investment provides high liquidity since shares can easily be bought and sold on the stock exchange during trading hours. It’s an ideal choice for investors who want exposure to gold prices without dealing with the issues associated with holding physical gold.

In 2024, given its convenience and efficiency in tracking gold prices, this type of investment could be particularly appealing for those looking for short-term exposure to the precious metal’s movements.

Gold Mining Stocks

Investing in stocks of gold mining companies is another approach to take part in the gold market. This option provides potential leverage over the price of gold because if the price of gold rises, typically so do the profits and hence the share price of the mining companies.

However, this investment is also tied to other factors, such as production costs, mine quality, management efficiency, and geopolitical risks where mines are located. Thus, it carries more risk than simply investing in pure gold but also offers significant growth potential in 2024 as new mines come online or exploration increases.

Gold Futures Contracts

Futures contracts can provide leverage as well because you’re only required to put down a fraction of the total value of the contract. These financial derivatives allow investors to speculate on future prices of gold but come with higher risk due to their complexity and leverage.

For sophisticated investors understanding market movements and willing to accept higher risks for potentially higher returns could consider this option in 2024.

Gold Mutual Funds

Gold mutual funds typically invest in an array of assets related to gold including physical bullion, ETFs, and mining stocks. This diversified approach reduces company-specific risks but still allows investors to benefit from overall movements in the price of gold.

Considering various investment horizons and risk appetites prevalent among different investor profiles in 2024, such mutual funds may present a balanced way for some individuals to gain exposure to gold.

Conclusion

The best type of gold investment ultimately depends on individual investor goals, risk tolerance, investment horizon and preferences when it comes to issues like liquidity versus tangibility. In 2024 as we see technology evolve further adding more dimensions such as security tokens representing physical bars or even cryptocurrency backed by physical reserves there will be more ways than ever before allowing investors various avenues through which they may choose how best to add the sheen of this precious metal into their portfolios.