The Truth About Filing Your Taxes on a Phone or Tablet

In today’s digital age, many aspects of our lives have been simplified with the help of smartphones and tablets. The rise of mobile devices has also made a significant impact on how we manage our finances, including the task of filing taxes. With numerous applications promising an easy and seamless experience, some people may wonder just how reliable and secure it is to file taxes using a phone or tablet.

Convenience at Your Fingertips

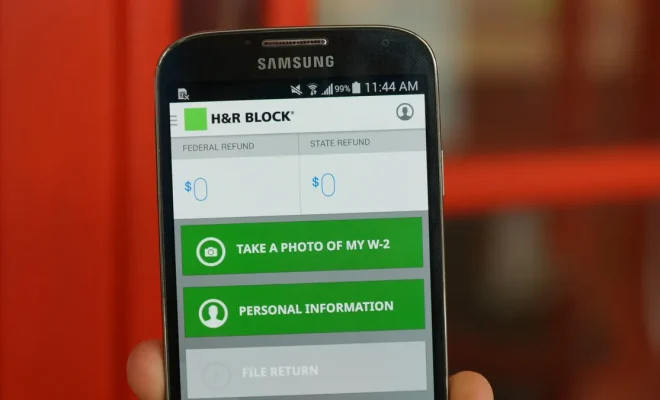

The primary reason people opt for mobile tax filing is sheer convenience. You can file your taxes from anywhere, whether you are sitting at home, taking a break at work, or waiting for your coffee at a cafe. Mobile applications developed by leading tax software providers like TurboTax and H&R Block offer user-friendly interfaces with step-by-step guidance to help even those with minimal tax knowledge.

Moreover, these applications often come equipped with features like document scanning and optical character recognition (OCR), which enables users to easily import W-2 forms or other tax documents by taking a picture.

Security Measures

One of the most significant concerns when filing taxes through mobile devices is data security and privacy. However, major e-filing platforms ensure that stringent measures are in place to protect your sensitive information. Encryption protocols, multi-factor authentication, and personal identification numbers (PINs) provide layers of security throughout the entire process.

Nevertheless, it is crucial to practice good security habits on your part as well. Avoid using public Wi-Fi networks while e-filing as they can be vulnerable to cyberattacks. Additionally, keep your mobile device updated with the latest security patches and use strong passwords for improved safety.

Limitations

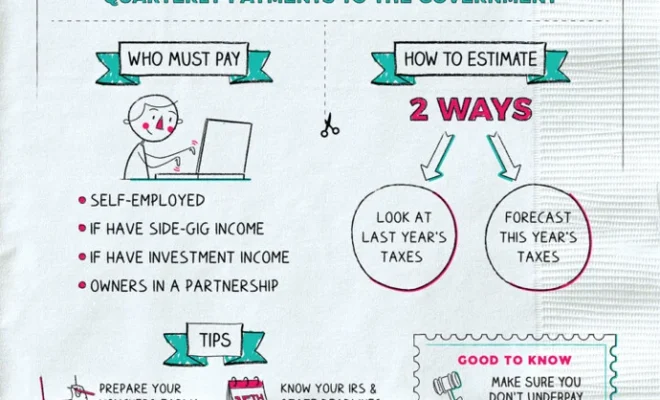

Although mobile tax filing provides convenience and ease in filing simple tax returns (e.g., 1040EZ), those with complex financial situations may find it harder to navigate through the process using smaller device screens. Taxpayers with multiple income streams, investments, rental properties, or self-employment might find the limited screen size less conducive to an accurate tax return.

Furthermore, if you require assistance from tax professionals or customer support, having a more extensive desktop platform may offer better communication options and resources. However, most mobile applications do still offer customer support through chat or phone lines.

In Conclusion

Filing your taxes on a phone or tablet has come a long way in recent years. With the ease of use and robust security provided by reputable tax software providers, there is no reason to fear using these platforms, especially for those with relatively straightforward financial situations. However at the same time, it is essential to understand that mobile tax filing apps may not be suitable for every financial situation and must be approached with sensibility and caution.