The Best Vanguard Funds

Vanguard is a well-known investment management company that has earned the trust of countless investors for their high-quality, low-cost mutual funds and ETFs. Selecting the best Vanguard funds can be a challenge, given the vast array of options available. In this article, we’ll dive into some of the top-performing Vanguard funds to help you make an informed decision for your investment portfolio.

1. Vanguard Total Stock Market Index Fund (VTSMX/VTSAX)

The Vanguard Total Stock Market Index Fund offers investors broad exposure to the entire U.S. equity market, including small, mid, and large-cap growth and value stocks. With its low expense ratio and comprehensive market coverage, this fund is ideal for investors seeking long-term capital growth with moderate risk.

2. Vanguard 500 Index Fund (VFINX/VFIAX)

This fund seeks to replicate the performance of the S&P 500 Index by investing in stocks of the largest U.S. companies. An ideal choice for investors looking for large-cap exposure, the Vanguard 500 Index Fund boasts an extremely low expense ratio and has consistently outperformed actively managed large-cap funds.

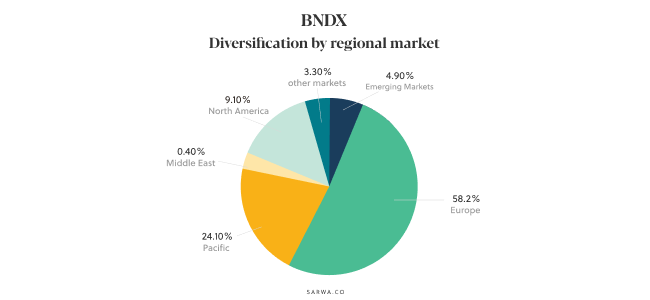

3. Vanguard Total International Stock Index Fund (VGTSX/VTIAX)

For investors seeking international exposure, this fund provides access to a diversified mix of stocks from both developed and emerging markets worldwide. Offering an opportunity for long-term capital appreciation while mitigating risk with its broad asset allocation, it’s a suitable option for those looking to diversify their holdings globally.

4. Vanguard Total Bond Market Index Fund (VBMFX/VBTLX)

This fixed-income fund provides exposure to a broad range of U.S. investment-grade bonds across various issuers and maturities. With its low costs and diversified approach, this fund aims to provide a steady income stream and is suitable for conservative or income-oriented investors.

5. Vanguard Small-Cap Value Index Fund (VISVX/VSIAX)

Investors seeking an attractive risk-to-reward ratio should consider the Vanguard Small-Cap Value Index Fund. This fund targets undervalued small-cap stocks with potential for long-term growth. Its low expense ratio and solid historical performance make it an appealing choice for aggressive investors looking for diversification in their domestic equities.

6. Vanguard Real Estate Index Fund (VGSLX/REIT)

This Real Estate Index Fund offers investors exposure to U.S. real estate investment trusts (REITs), providing a great opportunity for portfolio diversification and income generation from dividend-paying holdings. Suitable for investors aiming to hedge against inflation, this fund has a moderate risk profile and is known to provide decent returns over time.

When selecting the best Vanguard funds for your investment portfolio, it’s essential to consider your risk tolerance, time horizon, and investment objectives. By choosing well-diversified, low-cost funds like those mentioned above, you can optimize your returns while minimizing risk over the long term. Remember, it’s wise to consult with a financial advisor before making any investment decisions to ensure you’re making choices that align with your unique financial goals.