The Best Retirement Plans for Self-Employed Workers

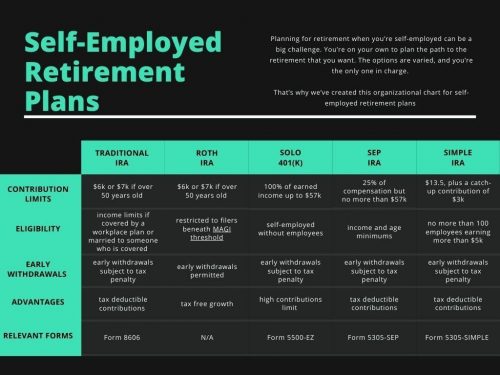

As a self-employed worker, planning for retirement is crucial to ensure you can maintain financial stability and security later in life. There are several retirement plan options designed specifically for self-employed individuals and small business owners. To choose the best one for your needs, it’s essential to understand how each works and the benefits they offer. In this article, we’ll discuss some of the best retirement plans available to self-employed workers.

1. Individual 401(k) or Solo 401(k)

One popular option for self-employed individuals is the Individual 401(k), also known as a Solo 401(k). This plan allows you to manage both the employer and employee aspects of a traditional 401(k) while taking advantage of tax-deferred growth on investments.

By electing to contribute as both an employee and employer, you can maximize your annual contributions. In 2022, individual contribution limits are set at $20,500 ($27,000 for those aged 50 or above), while employer contributions can be up to an additional 25% of your net self-employment income.

2. Simplified Employee Pension (SEP) IRA

Another excellent choice for self-employed workers is the Simplified Employee Pension (SEP) IRA. This type of plan enables you to make pre-tax contributions directly to an individual retirement account (IRA), reducing your taxable income and facilitating tax-deferred growth.

In 2022, SEP IRA contribution limits stand at the lesser of 25% of your net self-employment income or $61,000. A significant advantage of this plan is its simplicity and ease of administration compared to other retirement options.

3. Savings Incentive Match Plan for Employees (SIMPLE) IRA

The SIMPLE IRA is a cost-effective option targeted at small businesses with fewer than 100 employees and self-employed individuals. In this plan, you contribute pre-tax dollars as an employee and then match those contributions as an employer.

For 2022, the SIMPLE IRA contribution limit is $14,000 (or $17,000 for individuals aged 50 and above). Additionally, employer matching contributions are capped at a 3% salary deferral. SIMPLE IRAs are relatively straightforward to set up and administer, making them an attractive choice for small operations with limited resources.

4. Roth IRA

While not designed specifically for self-employed workers, the Roth IRA can be a beneficial retirement planning tool for those who qualify. Contributions to a Roth IRA are made with after-tax dollars, allowing your investments to grow tax-free. Qualified withdrawals in retirement are also tax-free, providing a significant tax advantage over time.

The 2022 contribution limits for Roth IRAs are $6,000 or $7,000 for individuals aged 50 or older. To fully contribute to a Roth IRA, your modified adjusted gross income must be below $129,000 for single filers or $204,000 for married couples filing jointly.

In conclusion, there are several retirement plans available to self-employed workers and small business owners that provide distinct advantages and cater to individual needs. Careful consideration of these options will help secure your financial future as you work toward retirement.