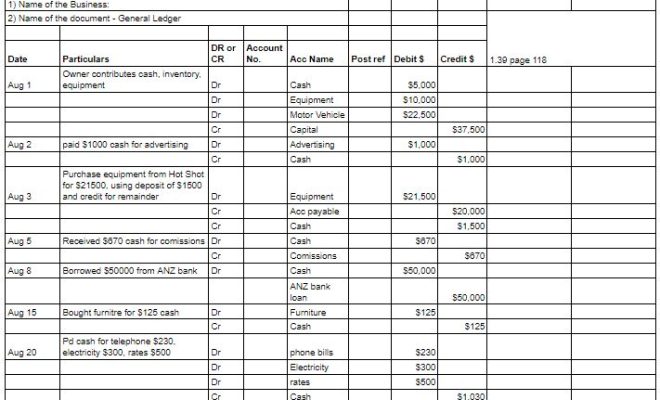

How to Write an Accounting Ledger

An accounting ledger is an essential tool for recording and tracking financial transactions in a business. It serves as the foundation of an organization’s bookkeeping system, helping to ensure accurate and transparent financial reporting. The process of writing an accounting ledger can be straightforward if you understand the basic principles and follow some simple steps.

1. Choose the type of ledger:

First and foremost, you need to determine which type of accounting ledger is best suited to your business needs. There are two primary types of ledgers: the general ledger and subsidiary ledgers. The general ledger contains all the financial information for your company, while subsidiary ledgers focus on specific accounts (e.g., accounts receivable, accounts payable).

2. Create the account format:

Each account in an accounting ledger should have a unique account number, a title or description, and sections for debits and credits. The format may vary depending on your organization’s accounting system, but it generally follows this structure:

Account Number | Account Title | Debits | Credits

3. Record your opening balances:

When you first set up your accounting ledger, you’ll need to record the opening balances from each account in your chart of accounts. Opening balances can come from various sources, such as previous financial records or initial investments.

4. Enter transactions chronologically:

As financial transactions occur in your business, make sure to record them in the appropriate accounts and with accurate dates. Posting your entries chronologically helps ensure that all transactions are captured in the right order and becomes easier for future review.

5. Apply the double-entry bookkeeping system:

The double-entry bookkeeping system mandates that each financial transaction must have at least two corresponding entries: one debit and one credit entry. This method ensures that your accounting ledger remains balanced at all times, with total debits equal to total credits.

6. Summarize each account periodically:

At regular intervals—such as monthly or quarterly—you should tally the debits and credits in each account to determine their balances. These balances can be carried forward to the next reporting period, providing a starting point for new transactions.

7. Review and reconcile your accounts:

Reviewing your accounting ledger is a vital aspect of maintaining accurate financial records. Compare the balances in your ledger with external documents like bank statements, invoices, and receipts to ensure that all transactions are accurately recorded. If discrepancies arise, investigate and correct them accordingly.

8. Close your accounting period:

At the end of each accounting period, you’ll need to close your books by finalizing the financial statements and transferring temporary accounts to permanent ones (e.g., transferring revenue and expenses to retained earnings). This process resets the temporary accounts, preparing them for a new accounting period.

In conclusion, an organized and accurate accounting ledger is essential for any business looking to stay on top of its finances. By understanding how the process works and following these straightforward steps, you’ll be well on your way to maintaining a reliable bookkeeping system that ultimately saves time and helps drive informed financial decisions.