How to calculate yield percent

Introduction

Yield percent, a widely used term in various industries such as chemistry and finance, provides a critical metric to measure the efficiency or profitability of a process or investment. In this article, we will explore the concept of yield percent in-depth and discuss ways to calculate it based on different scenarios.

Understanding Yield Percent

Yield percent refers to the ratio of the final product’s quantity to the initially-involved resources or investments. It helps determine the success or failure of an operation by providing insights into the efficiency and effectiveness of resource utilization.

Calculating Yield Percent in Chemistry

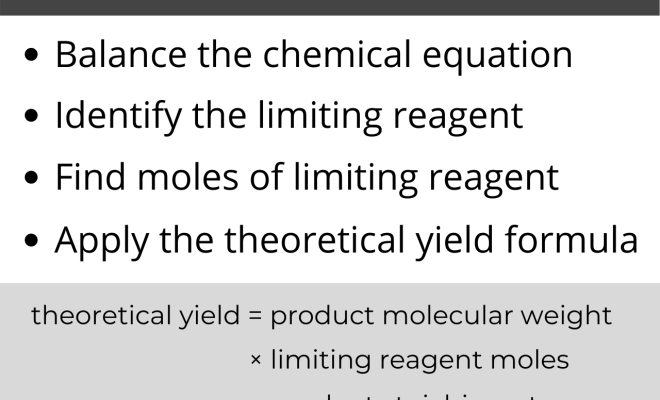

In chemistry, yield percent is used to represent the measure of efficiency and effectiveness of a reaction. The formula for calculating yield percent in chemistry is as follows:

Yield Percent = (Actual Yield / Theoretical Yield) × 100%

Here, actual yield refers to the experimentally obtained quantity of the desired product, while theoretical yield represents the maximum amount expected from stoichiometric calculations.

Let’s consider an example. To synthesize 10 grams of product A, you perform a chemical reaction. Based on stoichiometric calculations, your theoretical yield should be 15 grams. However, after completing the reaction and purifying your product, you obtain only 7 grams of product A. Now we can calculate the yield percentage:

Yield Percent = (7g / 15g) × 100% = 46.67%

Calculating Yield Percent in Finance

In finance, yield percent represents the annual return on an investment as a percentage of its cost. It provides valuable information about the profitability and attractiveness of financial instruments such as bonds and dividend stocks. The formula for calculating yield percent in finance is as follows:

Yield Percent = (Annual Cash Income / Cost of Investment) × 100%

Here, annual cash income refers to interest or dividend payments received yearly from your investment, while the cost of investment is the price paid to acquire the financial instrument.

For instance, you purchased a bond with a face value of $1000, and it pays an annual interest of 5%, i.e., $50 per year. Assuming you acquired the bond at its par value, we can calculate the yield percent as:

Yield Percent = ($50 / $1000) × 100% = 5%

Conclusion

Yield percent provides a crucial metric for assessing the efficiency or profitability of various processes and investments across different industries. By understanding how to calculate yield percent, you can make better decisions and improve your operations or investments’ performance. It is essential to remember that the method for calculating yield percent may vary depending on the industry and context in which it is used. Therefore, always ensure using the appropriate formula to obtain accurate results that enable informed decision-making.