How to calculate year over year change

Introduction

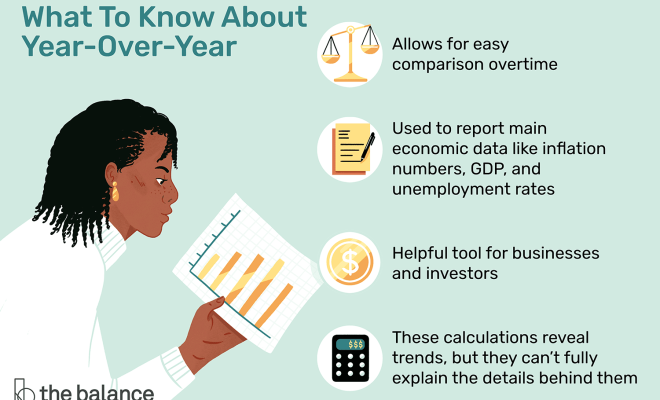

Year over year (YoY) change is a widely-used financial metric that allows companies and investors to analyze the performance of a business, investment, or any financial variable over time. This measurement compares growth or decline between two consecutive years and is generally presented as a percentage. Understanding how to calculate YoY change is essential for anyone interested in assessing the progress or decline of a venture.

In this article, we will explain in detail how to calculate year over year change with clear examples and applications.

Step By Step: Calculating Year Over Year Change

Step 1: Obtain the data

The first step in calculating YoY change is gathering the data for the variable you wish to analyze. This information usually comes from financial statements or records. For example, if you want to assess the YoY growth of a company’s revenue, you will need its annual revenue figures for the current and previous years.

Step 2: Develop the formula

The YoY change formula is relatively simple:

YoY Change (%) = ((This year’s value – Last year’s value) / Last year’s value) x 100

This formula calculates the percentage difference between two consecutive years’ values, indicating either growth or decline.

Step 3: Perform the calculation

Using the formula outlined above, insert your relevant values into their respective places. Subtract last year’s value from this year’s value, divide that result by last year’s value, and then multiply by 100 to convert it into a percentage.

Example:

Let’s assume Company A has an annual revenue of $400,000 this year and had an annual revenue of $300,000 last year. To calculate its YoY revenue growth:

YoY Growth (%) = (($400,000 – $300,000) / $300,000) x 100 = ($100,000 / $300,000) x 100 = 0.3333 x 100 = 33.33%

In this example, Company A experienced a YoY revenue growth of 33.33%.

Application of Year Over Year Change

Calculating YoY change is applicable in various contexts, including:

1. Revenue Growth: Assess a company’s progress by comparing revenue figures across two consecutive years.

2. Expense Analysis: Track the growth or reduction of specific expenses, such as staffing or marketing costs.

3. Investment Analysis: Evaluate the performance of stocks, bonds, or other investments by checking annual rate-of-return comparisons.

Conclusion

Calculating year over year change is an essential skill for anyone involved in finance, business management, or investing. By comparing data across consecutive years, you can gain valuable insights into a venture’s overall performance and make informed decisions moving forward. By following the straightforward steps outlined in this guide, you’ll be well-equipped to calculate YoY change with ease and confidence.