How to calculate mortgage rate

Introduction

Whether you’re purchasing a new home or refinancing an existing one, understanding how to calculate your mortgage rate is an essential skill. By grasping how mortgage rates work, you will be better equipped to make smart financial decisions and save money over the life of your loan. In this comprehensive guide, we’ll break down the steps required for calculating your mortgage rate and offer tips to help you get the best rate possible.

Step 1: Understand the Key Components

A mortgage interest rate is determined by a combination of factors:

1. Base Rate: Also known as the prime rate, this is the benchmark interest rate that lenders use as a starting point before adding or subtracting any adjustments specific to your loan.

2. Loan Term: The length of time over which you agree to repay the loan – typically 15 or 30 years.

3. Loan Amount: The amount you borrow from a lender.

4. Down Payment: The amount you pay upfront for the home, with the remaining balance financed through a mortgage.

5. Credit Score: Your credit history affects the likelihood of getting a lower interest rate on your mortgage.

6. Points & Fees: Discount points are optional upfront fees paid to your lender in exchange for lower interest rates. Origination fees may also be applied, which cover the cost of processing your loan application and closing costs.

Step 2: Analyze Different Loan Types

The type of loan you choose can significantly impact your mortgage rate:

1. Fixed-Rate Mortgages: These loans have fixed interest rates for the entire duration of the loan term, which protects borrowers from potential interest rate increases.

2. Adjustable-Rate Mortgages (ARMs): These loans initially offer a lower fixed interest rate, which later adjusts periodically based on market conditions.

3. Federal Housing Administration (FHA) Loans: Designed for borrowers with less-than-perfect credit, FHA loans tend to have lower interest rates than conventional loans.

4. Veterans Affairs (VA) Loans: Available to eligible veterans and their families, these loans often come with low or no down payment requirements and competitive interest rates.

Step 3: Get Quotes From Multiple Lenders

Contact multiple lenders to request personalized quotes for your specific loan situation. Comparing quotes from different lenders will not only help you gain a better understanding of the mortgage rate market, but it will also allow you to negotiate better terms.

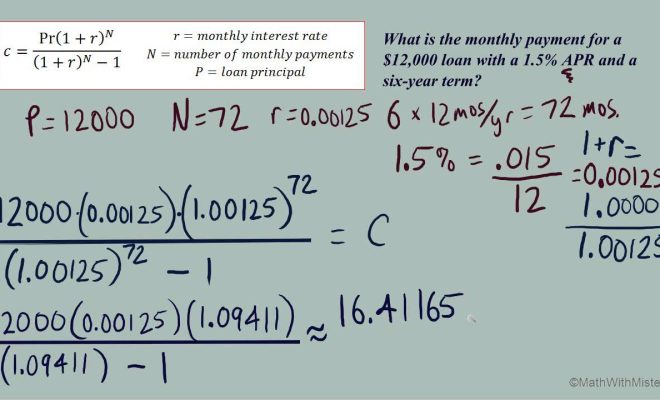

Step 4: Consider the Annual Percentage Rate (APR)

The APR includes both the mortgage interest rate and any additional loan fees and costs (such as points, closing costs, and other charges). It reflects the true cost of the loan over time, making it easier to compare offers from various lenders.

Step 5: Work on Your Credit Score

Improving your credit score before applying for a mortgage can lead to a more favorable interest rate. Some steps you can take include:

1. Paying bills on time

2. Lowering your credit utilization ratio

3. Removing errors from your credit report

4. Limiting new credit applications

Conclusion

Calculating your mortgage rate is an essential step in securing a home loan that fits comfortably within your budget. By understanding the key components, analyzing different loan types, comparing multiple quotes, considering APRs, and improving your credit score, you’ll be well on your way to achieving an ideal mortgage rate for your dream home.