How to calculate irr on ba ii plus

Introduction:

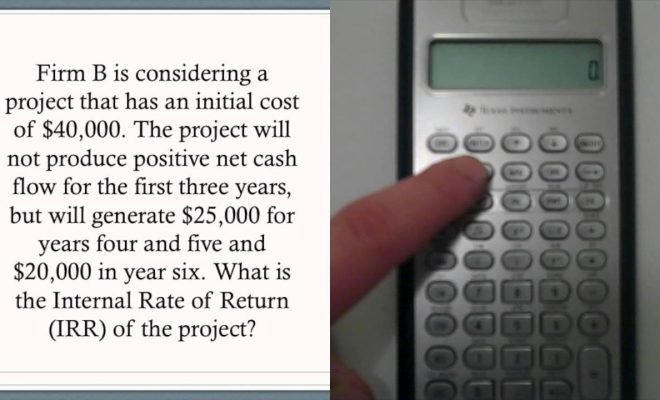

The BA II Plus is a popular financial calculator used by professionals in the fields of finance, business, and accounting. One of its many functions is the ability to calculate the internal rate of return (IRR) of an investment. IRR is the annualized rate of return at which the net present value (NPV) of a series of cash flows equals zero. In other words, it measures how much an investment can potentially earn over time. In this article, we will guide you through the process of calculating IRR using your BA II Plus calculator.

Step 1: Set up your calculator

First, make sure your calculator is in the correct mode for calculating IRR. Press the “2nd” button, followed by “FORMAT” (which is above the “.” key). Check that “DEC” is set to 2 for two decimal places and press “Enter” to save.

Step 2: Enter cash flow values

Now, let’s start entering your investment’s cash flow values. Press the “CF” button to access the cash flow worksheet.

– For the initial investment amount, enter a negative value to signify a cash outflow. For example, if you invest $10,000, enter “-10000” and press “Enter.”

– Press the down arrow key to move to the next cash flow input.

– Continue entering subsequent positive or negative cash flow values as they occur in your investment timeline. As you proceed, press the down arrow after each entry.

Step 3: Optional – Define cash flow frequencies

In some cases, specific cash flows might repeat multiple times before changing. To account for these situations, you can enter a frequency value.

– After entering a cash flow amount and pressing “Enter,” use the down arrow button once more.

– You will see “F01=”. This represents frequency.

– Enter the number of times the cash flow repeats before changing

– Press “Enter,” then use the down arrow to continue inputting cash flows.

Step 4: Calculate IRR

With all cash flow values inputted, it’s time to calculate the IRR.

– Press the “IRR” button, which shares a key with “NPV.”

– You may need to provide an initial guess for the IRR. Typically you can start with a guess of “10%” (without quotes), so type “10” and press “Enter.”

– Now, press the “CPT” button, followed by the “IRR” button.

– Your BA II Plus calculator will display the calculated IRR value.

Conclusion:

Calculating IRR on a BA II Plus financial calculator is a straightforward process if you follow these steps. With practice, you’ll be able to evaluate potential investments more effectively and make informed decisions on where to allocate your funds.