How to calculate interest revenue

Interest revenue is a significant source of income for both individuals and businesses, particularly for financial institutions like banks, credit unions, and other lending organizations. Properly calculating interest revenue is crucial to understanding the profitability of investments, loans, and other forms of income from interest-bearing assets. In this article, we’ll outline the key steps to calculate interest revenue and provide essential tips for maximizing your returns.

1. Understand the basics of interest

Interest is essentially the cost of borrowing money or the profit from lending it. There are two primary types of interest: simple and compound. Simple interest is calculated on the principal amount only, whereas compound interest takes into account both the principal amount and any accrued interest.

2. Identify the variables

To calculate interest revenue, you’ll need to gather some critical data points:

– Principal Amount (P): The original amount borrowed or invested

– Interest Rate (R): The percentage charged by a lender (or earned by an investor) annually

– Time Period (T): The duration over which the interest accrues, typically expressed in years

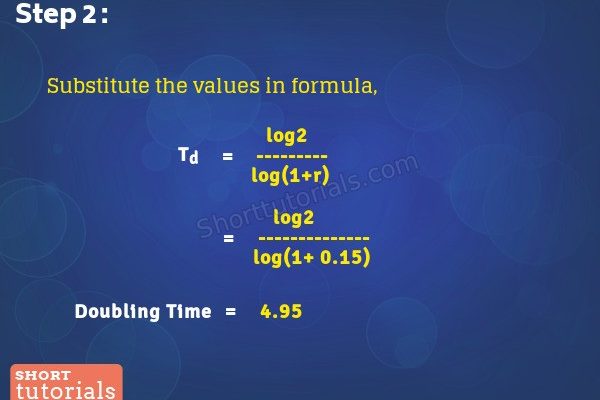

3. Choose an appropriate formula

Depending on whether you’re dealing with simple or compound interest, there are different formulas you can use:

Simple Interest:

Interest Revenue = P * R * T

Compound Interest:

Interest Revenue = P * (1 + R)^T – P

4. Perform the calculation

Once you have all the necessary information and chosen the appropriate formula, plug in the values and perform the calculation.

Example 1: Simple Interest

– Principal Amount: $10,000

– Interest Rate: 5% per year (or 0.05 when expressed as a decimal)

– Time Period: 3 years

Interest Revenue = $10,000 * 0.05 * 3 = $1,500

Example 2: Compound Interest

– Principal Amount: $10,000

– Interest Rate: 5% per year (or 0.05 when expressed as a decimal)

– Time Period: 3 years

Interest Revenue = $10,000 * (1 + 0.05)^3 – $10,000 = $1,576.25

5. Stay informed and monitor your interest revenue

Interest rates can change over time due to market fluctuations, economic conditions, and changes in policies by central banks. Staying informed about these changes and monitoring your interest revenue helps ensure you make informed decisions regarding lending, investing, or refinancing.

In conclusion, calculating interest revenue is an essential skill for individuals and businesses alike. By understanding the basics of interest and being able to identify key variables, using the appropriate formulas, and staying informed about changes in interest rates, you can better manage your finances and maximize your returns on investments and loans.