How to calculate how much tax you owe

Understanding how to calculate your taxes is an essential skill for anyone looking to properly manage their finances and stay in compliance with tax laws. In this article, we will provide a step-by-step guide to help you determine how much tax you owe.

Step 1: Determine Your Filing Status

Your filing status affects your tax rates and the standard deduction amount. The available filing statuses are Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child.

Step 2: Calculate Your Adjusted Gross Income (AGI)

To calculate your AGI, start by gathering all your income sources. These may include wages, interest, dividends, business income, capital gains/losses, unemployment benefits, alimony received or paid, and retirement distributions. Once you have this information, subtract any allowed adjustments from your total income.

Adjustments can include individual retirement account (IRA) contributions, student loan interest, alimony payments made and others listed on IRS Schedule 1.

Step 3: Determine Your Taxable Income

Next, subtract either the standard deduction (which varies depending on your filing status) or itemized deductions from your AGI. Common itemized deductions include mortgage interest payments, state and local taxes paid (up to $10,000), medical expenses exceeding 7.5% of AGI (for 2021), and charitable contributions.

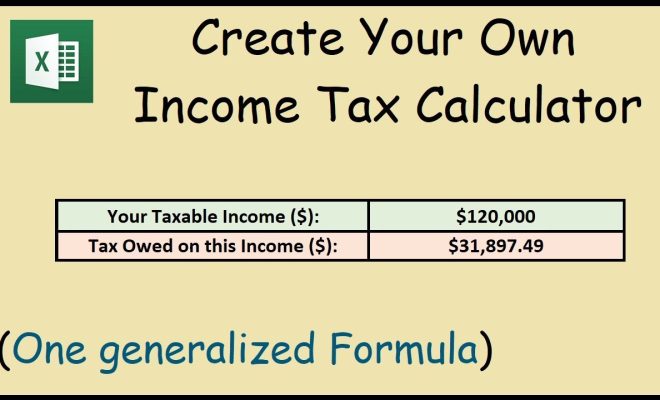

Step 4: Calculate Your Tax Liability

Using the IRS tax tables or appropriate tax brackets for the relevant tax year, match your taxable income with the corresponding rates to determine your federal income tax liability. Remember that U.S. federal income tax uses a progressive rate system – meaning that different portions of your income may be taxed at different rates.

Step 5: Determine Your Tax Credits

Tax credits can significantly reduce your tax liability. Some common tax credits include the Child Tax Credit, Earned Income Tax Credit (EITC), and education-related credits like the American Opportunity Tax Credit and the Lifetime Learning Credit. Carefully review eligibility criteria for each credit and subtract the total value of eligible credits from your tax liability.

Step 6: Calculate Tax Withheld and Estimated Payments

Review your income statements (e.g., W-2 or 1099 forms) to determine how much tax has already been withheld from your income throughout the year. If you made any estimated tax payments, add them to your total withheld amount.

Step 7: Calculate Amount Owed or Refund

Finally, subtract the total amount of tax withheld and estimated payments from your calculated tax liability to determine whether you owe additional taxes or are due for a refund. If the result is positive, you will need to pay that amount. If it is negative, this represents the refund you are entitled to receive.

By following these steps, you can accurately calculate how much tax you owe, ensuring that you remain in compliance with tax laws and maintain a healthy financial status. Remember that each individual’s tax situation is unique, and consulting with a professional tax advisor may be helpful to address more complex cases.