How to calculate ebit margin

The Earnings Before Interest and Taxes (EBIT) margin is a critical financial metric for businesses that allows investors and analysts to assess profitability. It measures a company’s earnings before taking into account interest expenses and income taxes while considering the company’s revenue. In this article, we will discuss the steps to calculate EBIT margin, its significance, and how it can prove beneficial for your business.

Step 1: Understanding EBIT Margin

EBIT margin is calculated by dividing a company’s Earnings Before Interest and Taxes by its total revenue. This margin provides an insight into a company’s operational efficiency by depicting how much of the total revenue is converted into operating income. A higher EBIT margin signifies lower operating expenses, which indicates better operational efficiency.

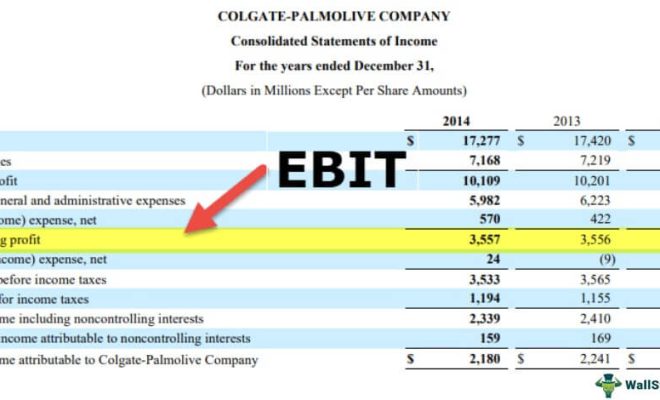

Step 2: Find the Operating Income

To calculate EBIT, you need first to determine your company’s operating income, which is also called operating profit or operating earnings. Operating income can be found on your company’s income statement and reflects the profits generated from everyday business operations, excluding interest expenses and taxes.

Step 3: Determine Total Revenue

Total revenue, also commonly referred to as sales or turnover, represents the total amount of money your company has earned from its core operations during a specific period. You can locate this figure on your company’s income statement.

Step 4: Calculate the EBIT Margin

To find the EBIT margin, simply divide operating income (also known as EBIT) by total revenue and then multiply the result by 100 to express it as a percentage. Here’s the formula:

EBIT Margin = (Operating Income / Total Revenue) x 100

Conclusion:

Calculating the EBIT margin allows businesses and investors to evaluate a company’s profitability while eliminating factors like tax rates or interest costs that might distort the true operational performance. Understanding and tracking this crucial metric can help identify areas of improvement and assess the effectiveness of business strategies, ultimately contributing to better decision-making processes.