How to calculate DSO

Days Sales Outstanding (DSO) is an essential financial metric that provides insights into a company’s efficiency in collecting receivables and managing credits. It helps identify the average number of days it takes for a business to collect payments on sales made on credit. In this article, we will walk you through the process of calculating DSO and provide tips for interpreting and improving this crucial metric.

Step 1: Understand the DSO Formula

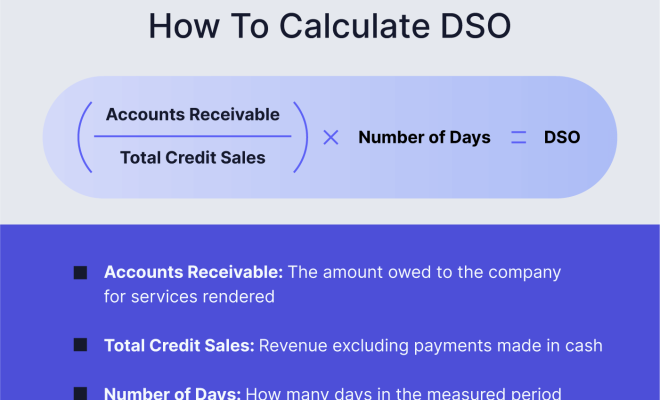

The DSO formula is as follows:

DSO = (Average Accounts Receivable / Net Credit Sales) × Number of Days

This formula consists of three main components:

1. Average Accounts Receivable: This is the average balance of your accounts receivable during a specific period.

2. Net Credit Sales: These are your total sales made on credit, excluding any returns or allowances, during the same period.

3. Number of Days: This refers to the number of days in the given period.

Step 2: Gather Required Data

To calculate DSO, you need to have access to two essential pieces of data:

1. Your company’s accounts receivable balance at the beginning and end of the period.

2. The net credit sales made during that period.

You can find these figures on your company’s balance sheet and income statement.

Step 3: Calculate Average Accounts Receivable

First, determine your average accounts receivable balance for the chosen period by adding the beginning and ending balances and then dividing by two:

Average Accounts Receivable = (Beginning AR + Ending AR) / 2

Step 4: Calculate DSO

Now plug in your calculated average accounts receivable and net credit sales into the DSO formula:

DSO = (Average Accounts Receivable / Net Credit Sales) × Number of Days

Your calculated number represents the average number of days it takes your business to collect payments from customers after making credit sales.

Interpretation and Improvement

A lower DSO generally indicates better efficiency in accounts receivable management and shorter collection cycles. Comparing your DSO to industry benchmarks can help identify areas for improvement. Some strategies for improving DSO include:

1. Implementing clear credit policies and consistently enforcing payment terms.

2. Offering early-payment discounts to incentivize prompt payment.

3. Conducting regular accounts receivable reviews to identify problematic customers.

4. Streamlining your invoicing processes to ensure timely and accurate billing.

Conclusion

Calculating Days Sales Outstanding (DSO) is a valuable exercise for businesses looking to improve cash flow management and effectively assess their credit practices. By monitoring DSO regularly and comparing it to industry standards, you can identify opportunities for improvement, optimize customer payment habits, and strengthen your company’s financial position.