How to calculate dividend yield

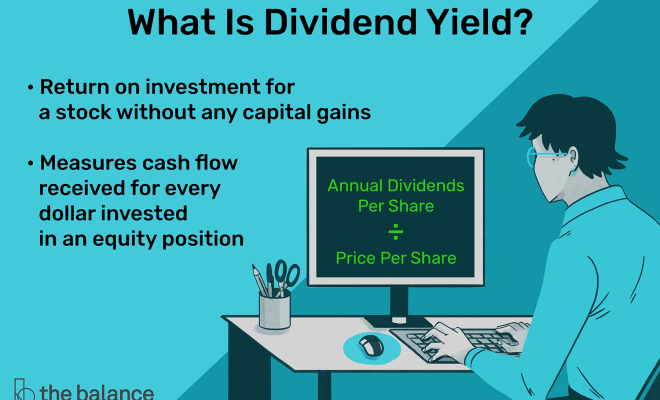

Dividend yield is a financial metric that helps investors determine the amount of money a company returns to its shareholders in the form of dividends, relative to the stock’s price. It is often used by income-focused investors who seek to maximize their cash flow from investments. In this article, we will delve into how dividend yield is calculated and what factors can impact its value.

Step 1: Understand Key Components

To calculate dividend yield, you will require two key components:

1. Annual dividend per share (DPS): This figure represents the total dividends paid out to shareholders over a one-year period, divided by the total number of shares outstanding.

2. Current market price per share: This is the current trading price of a single share of stock on a publicly traded market.

Step 2: Obtain Relevant Data

Both DPS and the current market price per share can be sourced through various channels:

1. Company earnings reports: Companies typically announce dividends and outstanding shares in their quarterly or annual reports.

2. Financial websites: Websites like Yahoo Finance, Google Finance, and others offer updated stock prices and dividend information.

3. Stockbroker platforms: Online trading platforms often provide dividend information and real-time stock prices.

Step 3: Calculate Dividend Yield

Once you have gathered the necessary data, calculating dividend yield is fairly straightforward:

Dividend Yield = (Annual Dividend per Share / Current Market Price per Share) x 100%

For example, if a company’s annual DPS is $2 and its current market price per share is $50:

Dividend Yield = (2 / 50) x 100% = 4%

In this case, the dividend yield would be 4%.

Factors That Can Impact Dividend Yield:

1. Changes in dividend payouts: If a company increases or decreases its dividends, it will affect the dividend yield.

2. Stock price fluctuations: Changes in the stock’s market price can significantly impact the dividend yield.

3. Payout ratios and sustainability: A high payout ratio (the percentage of earnings paid out as dividends) can signal that a company might not be able to sustain its dividends in the future.

Conclusion:

Calculating dividend yield is an essential step for income-driven investors who are interested in maximizing their returns from their investments. Understanding how this metric is calculated and the factors affecting it can help investors make well-informed decisions about their portfolios and investment strategies.