How to calculate discount cash flow

Discounted cash flow (DCF) is a financial analysis tool used to value investments, such as stocks, bonds, or projects. It measures the present value of future cash flows generated from an investment by discounting them back to today’s value. The purpose of calculating DCF is to determine whether an investment is worth pursuing and at what price. This article will guide you through the steps in calculating discounted cash flow.

Step 1: Identifying the expected future cash flows

To start, you need to gather information about the project or investment, like revenue projections, operating costs, maintenance costs, and other factors relevant to your investment. This information helps you estimate the expected future cash flows for each period in your analysis. Cash flow can be positive or negative, depending on the income generated and expenses in each period.

Step 2: Determining the discount rate

The discount rate is the interest rate used to calculate the present value of future cash flows. Several factors may influence the choice of this rate, including risk-free rates (such as U.S. Treasury bonds), inflation expectations, and risk premiums associated with your specific investment. Generally, a higher discount rate reflects greater uncertainty around expected cash flows.

Step 3: Calculating the present value of each cash flow

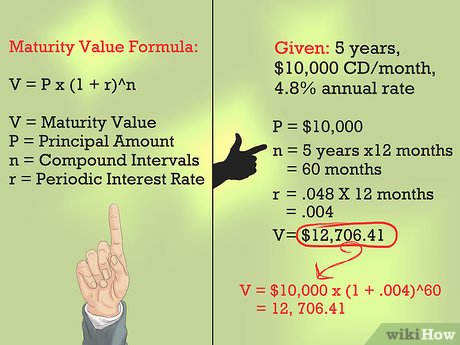

Once you have identified your expected future cash flows and determined a discount rate, it’s time to calculate their present values. To do this, use the following formula:

Present Value (PV) = Future Cash Flow / (1 + Discount Rate)^n

In this formula, n represents the number of periods into the future where the cash flow occurs.

Step 4: Summing up present values

Now that you’ve calculated all individual present values for each period into the future, simply sum up all these values to achieve your total discounted cash flow.

Total Discounted Cash Flow (DCF) = PV₁ + PV₂ + PV₃ + … + PVn

Step 5: Evaluating the investment

With the total discounted cash flow value in hand, you can now evaluate your investment. If the DCF value is higher than the initial investment cost, it suggests that the investment may be a good opportunity. However, if the DCF value is lower than the initial investment cost, it may not be worth pursuing.

Conclusion:

Calculating discounted cash flow is an essential skill for investors in various industries to understand the potential value and return on investment accurately. By following these steps, you’ll be well-equipped to make informed decisions on your financial ventures. Remember to always consider other qualitative factors alongside your DCF analysis, as they could also significantly impact any returns from a specific investment.