How to calculate capex

Introduction

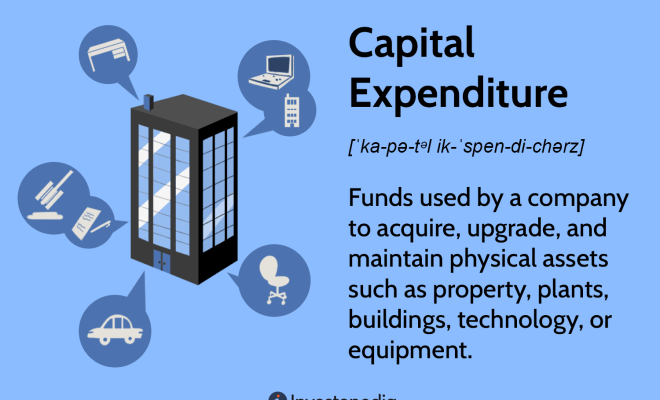

Capital Expenditures, or CAPEX, is a term used in the world of finance to describe the investments made by businesses in acquiring, maintaining, or improving their fixed assets. These assets can include equipment, machinery, buildings, and infrastructure.

Understanding how to calculate CAPEX is essential for managers, investors, and financial analysts as it provides insights into a company’s financial health and efficiency.

In this article, we will break down the process of calculating capital expenditures and provide step-by-step guidelines to help you understand this important financial metric.

Step 1: Identifying CAPEX

The first step in calculating CAPEX is identifying it in a company’s financial statements. Capital expenditures are generally found in the cash flow statement under the investing activities section. They may also be referred to as property, plant, and equipment (PP&E) or simply as capital expenses.

Step 2: Gathering Financial Data

To calculate CAPEX, you will need to gather data from the company’s balance sheet and income statement. Specifically, you will need:

1. Property, Plant, and Equipment (PP&E) from the beginning of the year – This can be found on the balance sheet from the start of the financial year.

2. Property, Plant, and Equipment (PP&E) from the end of the year – This can be found on the balance sheet at the end of the financial year.

3. Depreciation expense for the year – This can be found on the income statement.

Step 3: Calculate CAPEX

Once you have gathered all necessary data points, you can follow these steps to calculate capital expenditures:

1. Calculate the change in PP&E by subtracting beginning PP&E from ending PP&E:

Change in PP&E = (Ending PP&E) – (Beginning PP&E)

2. Add back depreciation expense for the year:

CAPEX = Change in PP&E + Depreciation Expense

Step 4: Analyze CAPEX

After the calculation, it’s essential to analyze the capital expenditures. A high CAPEX could suggest that a company is heavily investing in its future growth and development, while a low CAPEX might indicate a lack of investment in these areas. However, the appropriate level of CAPEX is subjective and may vary depending on factors such as industry, business size, and long-term strategy.

Conclusion

Calculating capital expenditures (CAPEX) is an essential skill for anyone involved in financial management or investment analysis. This metric helps businesses and investors understand where a company is investing its resources and how efficiently it’s allocating capital toward long-term growth. By following the steps outlined in this article, you will be well-equipped to calculate and analyze capex for any organization.