How to Calculate Beta

Introduction

In the world of finance, understanding and managing risk is crucial for investors. One common measure of risk is known as beta (β), which helps assess the volatility of a particular investment in relation to the overall market. In this article, we will discuss what beta is, why it’s important, and how to calculate it.

What is Beta?

Beta is a measure of an investment’s systematic risk or volatility compared to the market as a whole. It is commonly used in portfolio management and risk analysis, as it offers a way to gauge how much an investment contributes to overall market risk. A beta value of:

1. 1 indicates that the investment’s price moves in the same direction and magnitude as the market.

2. Greater than 1 suggests that the investment is more volatile than the market.

3. Less than 1 implies that the investment is less volatile than the market.

Calculating Beta

There are various methods for calculating beta, but here we will focus on two primary techniques: regression analysis and covariance/correlation method.

1. Regression Analysis:

Regression analysis uses historical data on both an individual investment and its benchmark index (e.g., S&P 500) to determine beta value. Follow these steps:

a. Collect historic price data: First, gather price data for the individual stock and its benchmark index over a specific period (e.g., daily or monthly prices for one year).

b. Calculate returns: Calculate percentage returns by dividing current price by the previous price and then subtracting 1.

c. Run a linear regression: Use software like Microsoft Excel or statistical packages like R or Python to run a linear regression with stock returns as dependent variable and benchmark returns as independent variable.

d. Obtain beta value: The slope coefficient (ß) in this linear regression will be your beta value.

2. Covariance/Correlation Method:

Covariance measures how two variables move in relation to each other, while correlation is a standardized measure of covariance, ranging from -1 to 1. Here’s how to calculate beta using this method:

a. Collect historic price data: Just like in regression analysis, gather price data for the individual stock and its benchmark index over a specific period.

b. Calculate returns: Calculate percentage returns as described earlier.

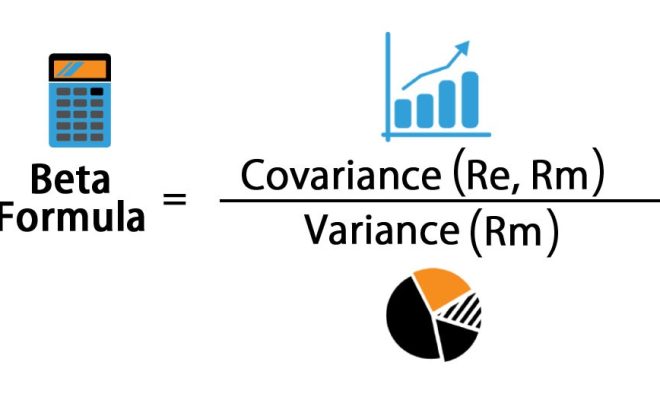

c. Calculate covariance and variance: Find covariance between the returns of the stock and the benchmark index and also find variance of the benchmark index returns.

d. Obtain beta value: Divide the covariance value by the variance value to get beta.

Beta Calculation Example

Let’s say we want to calculate the beta for Stock X over a one-year period using monthly data, taking S&P 500 as our benchmark index. After gathering this data, we follow these steps:

1. Calculate monthly stock returns for Stock X and S&P 500.

2. Using regression analysis or covariance/correlation method, obtain beta value.

Interpreting Beta

Knowing the beta value of an investment allows investors to understand how it moves alongside market fluctuations.

– A beta of exactly 1 implies that the asset is in sync with market movements.

– A high positive beta (greater than 1) indicates that stock will likely perform well during market upswings but may suffer during downturns.

– A low positive beta (less than 1) shows lower volatility than the market while still moving roughly in tandem.

– Negative beta values signal that an investment tends to move in the opposite direction of the market.

Keep in mind that historical data is not always a perfect indicator of future performance. Nevertheless, understanding and calculating beta remains an essential skill for evaluating an investment’s potential risks relative to market fluctuations.