How to Buy Put Options: 14 Steps

In the world of investment, put options can serve as a valuable tool for hedging or speculating on the movement of a stock’s price. Buying a put option allows you to profit when the price of a stock drops. This article will walk you through 14 steps to help you successfully buy put options.

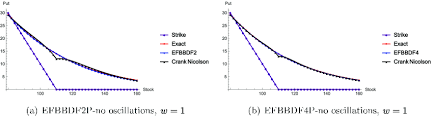

1.Understand what put options are: A put option gives the owner the right, but not the obligation, to sell a specific stock at a predetermined price (known as the strike price) before a set expiration date.

2.Learn the basics of options trading: Familiarize yourself with terminology such as strike price, expiration date, premium, and intrinsic value. Additionally, understand how options contracts work and how they are traded.

3.Open a brokerage account: Choose a reputable brokerage with low fees, user-friendly platforms, and excellent customer service. Make sure that they offer options trading. You may need to convert your existing account into an options trading account or open a new one.

4.Determine your risk tolerance: Think about how much money you are willing to risk in your investments and tailor your strategy accordingly.

5.Choose the right stock: Research and analyze stocks that you believe may experience a price decrease in the near future. Look at financial data, company performance, industry trends, and economic indicators.

6.Decide on the strike price: Select a strike price for your put option based on your analysis of the stock’s potential downward movement and your risk tolerance.

7.Choose an expiration date: Pick an expiration date for your put option that balances risk with potential reward. Generally, longer-dated options cost more but provide more time for your prediction to come true.

8.Calculate the premium: Premium is the amount paid for buying an option contract. It depends on various factors such as strike price, expiration date, stock volatility, and interest rates.

9.Analyze the option’s potential profit and loss: Before buying a put option, consider various scenarios and calculate potential profits or losses accordingly.

10.Place your order: Log in to your brokerage account, navigate to options trading, and place an order to buy a put option with your chosen stock, strike price, expiration date, and premium.

11.Monitor your investment: Keep a close eye on the stock’s performance as the expiration date approaches.

12.Decide whether to exercise or sell the put option: If the stock price decreases sufficiently below the strike price before the expiration date, you can choose either to exercise the option (sell your stock at the strike price) or sell the option contract itself for a profit.

13.Manage your tax implications: Profits from options trading may be subject to taxes depending on your jurisdiction. Consult with a tax advisor or do thorough research on how to report your gains and losses.

14.Learn from your experiences: As with any investment strategy, consistently review your trades, learn from both successes and mistakes, and refine your approach to buying put options over time.

By following these 14 steps, you’ll be well-equipped to begin buying put options and potentially profiting from falling stock prices. Remember to conduct thorough research, manage risk carefully, and stay informed about market trends and fluctuations.