How Often Are Dividends Paid & When Do You Get Them?

Introduction:

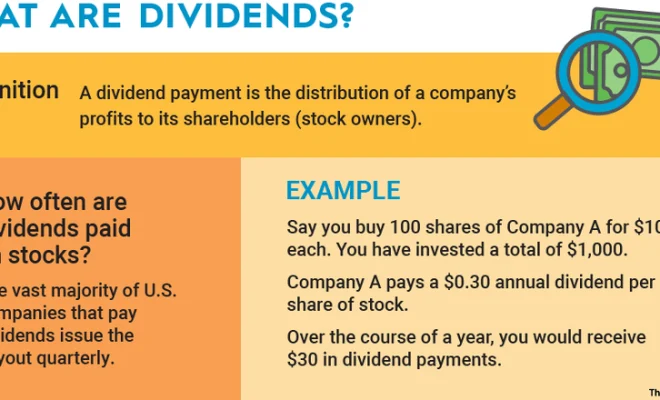

Dividends are payments made by companies to their shareholders as a reward for investing in their stock. They are a way for shareholders to receive a portion of the company’s profits, and can be an important source of income for many investors. But how often are dividends paid, and when do you get them? In this article, we will explore the frequency of dividend payments and the factors that determine when you can expect to receive them.

Frequency of Dividend Payments:

Dividends can be paid at various intervals depending on the company’s policy and financial performance. The most common dividend payment frequencies are:

1. Monthly – Some companies, especially those in the real estate investment trust (REIT) industry, pay dividends every month. This provides shareholders with a steady stream of income, although the amount may be smaller than with other payment frequencies.

2. Quarterly – Most publicly-traded companies in the United States pay dividends on a quarterly basis or every three months.

3. Semi-Annually – Some companies choose to pay dividends twice a year or every six months. This is common among European-based companies.

4. Annually – A few companies issue dividends only once per year. These tend to be smaller firms or those in industries with lower cash flow availability.

It is important to note that not all companies pay dividends regularly or consistently. Some businesses may suspend dividend payments temporarily during challenging financial periods or change the frequency based on their overall performance.

When Do You Get Them?

Companies follow a specific timeline that dictates when dividends are paid out to shareholders, which include several key dates:

1. Declaration Date – This is when the company’s board of directors announces the dividend amount and payment date.

2. Ex-Dividend Date – To qualify for the upcoming dividend payment, you must own shares before this date. Shareholders who purchase shares on or after the ex-dividend date will not receive the upcoming dividend.

3. Record Date – This is typically two business days after the ex-dividend date. The company identifies shareholders on their books as eligible for receiving the dividend payment based on the record date.

4. Payment Date – This is the day when dividend payments are distributed to shareholders, either through electronic transfer or by mailing a physical check.

Conclusion:

The frequency of dividend payments varies depending on the company and its financial performance, with most companies paying dividends quarterly. To ensure you receive dividend payments, it is essential to be aware of key dates such as the declaration date, ex-dividend date, record date, and payment date. By understanding how often dividends are paid and when you can expect to receive them, investors can effectively plan their financial goals and optimize their investment strategies.