How much should i pay for rent calculator

Introduction

Finding the perfect rental property can be a daunting task, especially when considering the variety of factors that contribute to one’s rental budget. This is where a rent calculator comes in handy, helping potential renters determine just how much they can afford to pay for rent based on their monthly income and expenses. In this article, we will discuss the concept of a rent calculator and how to use it effectively.

How Rent Calculators Work

A rent calculator is an invaluable tool that helps individuals estimate the maximum amount of rent they can afford based on their financial situation. Typically, it factors in various components such as monthly income, debt payments, cost of living expenses, desired savings, and other commitments.

Using these relevant pieces of information, the rent calculator computes the recommended rental payment as a percentage of an individual’s monthly net income (often 30%).

Why Use a Rent Calculator?

1. Affordability: A rent calculator ensures that renters do not end up committing to a property they eventually cannot afford, saving them from financial distress.

2. Budgeting: Knowing how much money can be allocated towards rent makes it easier to budget for other essential expenses such as utilities and groceries.

3. Time-Saving: With a clear picture of what rental price brackets best suit one’s budget, individuals can save time searching for properties within those ranges.

4. Avoid Overpaying: By understanding an appropriate maximum rent payment, tenants can avoid overpaying and ensure they are getting the most value for their money.

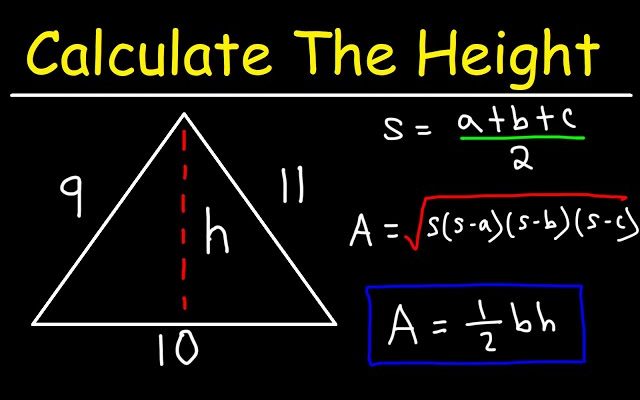

Steps to Calculate Your Ideal Rent Payment

1. Determine your monthly net income: This is your take-home income after accounting for taxes and other deductions from your paycheck.

2. List all fixed monthly expenses: These may include student loan payments, car loans, credit card bill payments, insurance premiums, or others.

3. Estimate variable living expenses: These include monthly costs like groceries, transportation, utilities, and other day-to-day expenses.

4. Set a savings goal: It is essential to account for your desired savings amount in your rent calculation — whether that is for emergency funds or future investments.

5. Add fixed expenses, variable expenses, and savings goals.

6. Subtract the sum from your monthly net income to find the amount left for rental payments.

7. Divide this number by your monthly net income and multiply it by 100 to obtain the percentage you can spend on rent. Ideally, this should be around 30%.

Of course, some rent calculators available online automatically perform these calculations to simplify the process further.

Conclusion

A rent calculator provides valuable insights into how much one should pay for rent. By accounting for income and current expenses, individuals can confidently approach their property search with a clear understanding of their budget limitations. By utilizing a rent calculator and following these steps, potential renters can save time, money, and stress while ensuring they find a suitable home that meets both their needs and financial capabilities.