How moving average is calculated

Introduction

A moving average is a widely used and versatile technique in finance, economics, and data analysis, as it helps to smooth out noise in datasets and highlight underlying trends. It can be easily calculated using simple arithmetic formulas and is applicable across different fields. In this article, we will explain the concept of moving averages, why they are important, and how they are calculated.

What is Moving Average?

A moving average is a mathematical tool used to analyze data points by creating a series of averages for different subsets of the data. It helps filter out the random fluctuations in data and identify a trend or pattern, making it easier to make informed decisions based on historical information.

Significance of Moving Average

1. Noise Reduction: Moving averages provide a way to smooth out raw data by reducing the impact of isolated outliers or random fluctuations, making it easier to spot underlying patterns.

2. Trend detection: Moving averages help in identifying the direction of trends by smoothing out short-term price volatility.

3. Easier decision-making: By simplifying large datasets and reducing noise, moving averages enable analysts and traders to make more informed decisions based on historical data.

Calculating Moving Averages

There are various types of moving averages such as simple moving average (SMA), weighted moving average (WMA) and exponential moving average (EMA). Here, we will discuss the calculation process for the simple moving average.

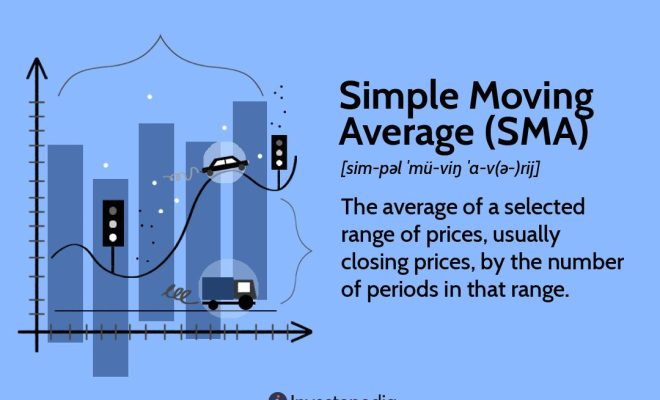

Simple Moving Average (SMA)

The simple moving average (SMA) is calculated by taking the arithmetic mean of a given set of prices over a specific time period (number of days). Here’s how it works:

1. Determine the time period: First, choose the number of days (n) over which you would like to calculate the moving average.

2. Gather historical data: Collect price data for ‘n’ consecutive days from your chosen dataset.

3. Calculate sum: Add the prices of all ‘n’ days together to find the sum.

4. Divide sum by time period: Finally, divide the sum obtained in step 3 by ‘n’ to get the moving average.

For instance, if you want to calculate the SMA for a 5-day period, you would collect price data for those five days, add them up, and then divide by 5. This would produce your moving average for that specific time period.

Conclusion

Moving averages are essential tools for analysts and traders as they help identify trends and make informed decisions based on historical data. Additionally, they can be combined with other indicators in finance or utilized in other fields for improved decision-making. The simple moving average calculation showcased in this article is just one of the methods used; weighted and exponential moving averages similarly have their unique calculations optimized for varying purposes.