How calculate net worth

Introduction

As an important measure of personal financial health, calculating one’s net worth is a valuable exercise for individuals seeking to gain insight into their overall financial standing. In this article, we will guide you through the process of determining your net worth.

What is Net Worth?

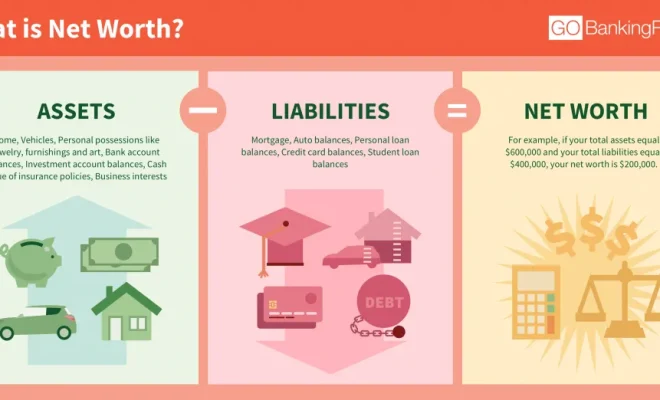

Net worth is the value of your assets minus your liabilities. It represents the total worth of everything you own after deducting any outstanding debts. A positive net worth signifies that you own more than you owe, while a negative net worth indicates that your liabilities exceed your assets.

Calculating Your Net Worth

1. List and Determine the Value of Assets:

Begin by listing all the assets you possess. Assets can include physical properties such as homes or cars, along with other investments like stocks, bonds, retirement accounts, and cash savings. Be sure to assign a fair market value to each asset while adding them up.

Asset categories:

– Real estate (primary residence, vacation homes, rental properties)

– Vehicles (cars, boats, motorcycles)

– Financial assets (savings accounts, checking accounts, stocks, bonds)

– Retirement accounts (401(k), IRAs, pensions)

– Personal property (jewelry, art, collectibles)

2. List and Determine the Value of Liabilities:

Next, create a list of all your current liabilities or debts—financial obligations that represent money owed to another party. Some common liabilities include mortgage balances, car loans, student loans and credit card debt. Add up the total amount owed for each liability.

Liability categories:

– Home mortgage

– Car loans

– Student loans

– Credit card debt

– Medical debts

– Personal loans

– Other outstanding debts

3. Subtract Your Liabilities from Your Assets:

Finally, subtract your total liabilities from your total assets to determine your net worth:

Net Worth = Total Assets – Total Liabilities

Interpreting Your Net Worth

It’s important to remember that net worth is just one factor in evaluating your personal financial health. While having a positive net worth is generally favorable, achieving financial stability requires more than a specific number. It involves understanding your current financial situation, setting realistic goals, and continuously working to improve your finances over time.

Regularly assessing your net worth can help you track your financial progress, make informed decisions about spending and saving, and identify areas for improvement.

In conclusion, calculating your net worth provides a valuable insight into your current financial position. By regularly monitoring the changes in assets and liabilities, you can adjust your financial strategy accordingly and strive for a stronger financial future.