How are student loan payments calculated

Introduction:

Student loan payments can be daunting for anyone who has taken out loans to finance their education. Still, it’s essential to understand how your loan payment is calculated, as this understanding can help you plan your repayment strategy more effectively. In this article, we’ll delve into the various factors that determine your student loan payment and discuss some common repayment plans.

Factors That Determine Your Student Loan Payment:

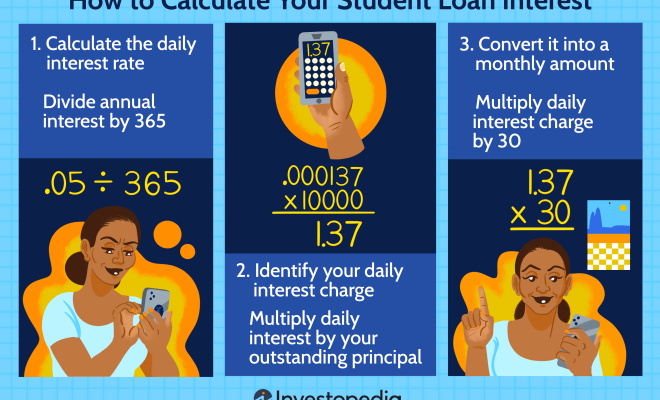

1. Principal Amount: The principal amount refers to the total amount you borrowed for your education. Your monthly payment will partly depend on the size of this initial loan balance.

2. Interest Rate: A significant factor in determining your monthly payment is the interest rate of your loan. The higher the rate, the more interest you will pay over the life of your loan, ultimately increasing your overall payment amount.

3. Loan Term: The loan term defines how long you have to repay your student debt. A shorter term generally means higher monthly payments but a lower total cost due to less interest accrued over time. On the other hand, a longer loan term will result in smaller monthly payments but may increase the overall cost due to more interest accrued.

4. Repayment Plan: Various repayment plans exist, each with different terms and conditions that could significantly impact your monthly payments. Examples include standard repayment, graduated repayment, extended repayment, and income-based or income-contingent repayment plans.

Repayment Plans Overview:

1. Standard Repayment Plan: This plan typically allows borrowers 10 years to repay their loans with fixed monthly payments. The standard repayment plan benefits those looking to minimize the total amount paid over time because of a shorter term and lower interest accumulation.

2. Graduated Repayment Plan: In a graduated repayment plan, you start with smaller monthly payments that gradually increase every two years or so. This plan can be right for borrowers expecting their income to rise over time; however, it may result in higher total costs due to more interest accrued.

3. Extended Repayment Plan: The extended repayment plan allows you to stretch your loan term to 25 years instead of the standard 10 years, which results in lower monthly payments but an increased overall cost.

4. Income-Based or Income-Contingent Repayment Plans: These plans set your monthly payments based on your income level, with regular adjustments typically made annually. These can be beneficial for borrowers who may struggle with high monthly payments due to low or unstable income.

Conclusion:

Understanding how student loan payments are calculated can help potential and existing borrowers make informed decisions regarding their loans. When planning your repayment, it’s crucial to weigh the pros and cons of different repayment plans and choose one that best fits your financial situation. Ultimately, staying informed and proactive about your loans will position you better for long-term financial success.