How are disability benefits calculated

Introduction:

Disability benefits are an essential lifeline to those who can no longer work due to a debilitating illness or injury. But how are these benefits calculated, and what factors determine the amount? This article delves into the key components and calculations of disability benefits.

1. Definition of Disability:

Before discussing the calculations, it is crucial to understand the definition of disability. The Social Security Administration (SSA) defines disability as the inability to engage in substantial gainful activity (SGA) due to a medically determinable physical or mental impairment that lasts for a minimum of 12 months or is expected to result in death.

2. Key Factors Influencing Disability Benefit Calculation:

Several factors determine the monetary value of disability benefits. These include:

i. Type of Disability Program: There are two primary disability programs – Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Each program has different eligibility criteria, and their respective benefit amounts vary based on different factors.

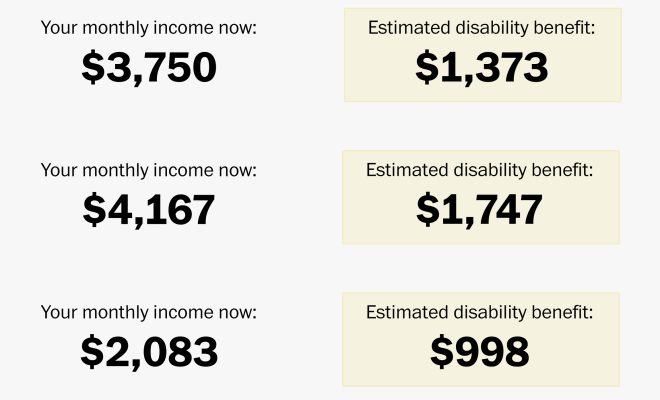

ii. Earnings Record: For SSDI payments, work history and earned income play a significant role in determining the benefit amount. The SSA calculates an applicant’s average indexed monthly earnings (AIME) by adjusting their career earnings according to national wage trends.

iii. Primary Insurance Amount (PIA): AIME is used to derive the PIA – which is the base figure for calculating SSDI benefits. Factors like an individual’s age and whether they have dependents can influence adjustments made to PIA.

iv. Family Maximum: In some cases, the SSA may divide an individual’s SSDI benefit among eligible family members as auxiliary benefits. The family maximum limit dictates the total payable benefits, ensuring strict adherence to capped amounts.

v. Disabled Worker Benefit Amount: The Disabled Worker Benefit Amount is calculated separately for both SSDI and SSI beneficiaries using various external factors such as cost-of-living adjustments (COLA), which vary annually based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

3. Specific Calculations for SSDI and SSI:

i. SSDI Calculation: SSA calculates SSDI benefits using a progressive formula to determine PIA, with three benefit rates applied to AIME. The rates and AIME thresholds change each year due to COLA adjustments. The sum of the three calculations determines the beneficiary’s monthly SSDI benefit.

ii. SSI Calculation: SSI benefits are determined by an individual’s income and living situation, with maximum Federal payment amounts set for eligible individuals or couples. Income deductions, state supplements, and cost-of-living adjustments are applied to calculate the final SSI benefit amount.

Conclusion:

Understanding how disability benefits are calculated is a complex yet vital process when applying for assistance due to a debilitating condition. With several factors influencing the final amount, it is crucial for applicants to understand their eligibility under the specified disability programs (SSDI or SSI) and how these criteria affect their potential benefit payments.