Compare Our Best Mortgage Rates

Purchasing a home is a significant milestone in anyone’s life, and finding the right mortgage rate can make a substantial difference in your financial future. With a plethora of options available in the market, it is crucial to compare and evaluate mortgage rates to secure the best deal. This article aims to guide you through the process of comparing mortgage rates, helping you save money and make an informed decision.

1. Understand different types of mortgage rates:

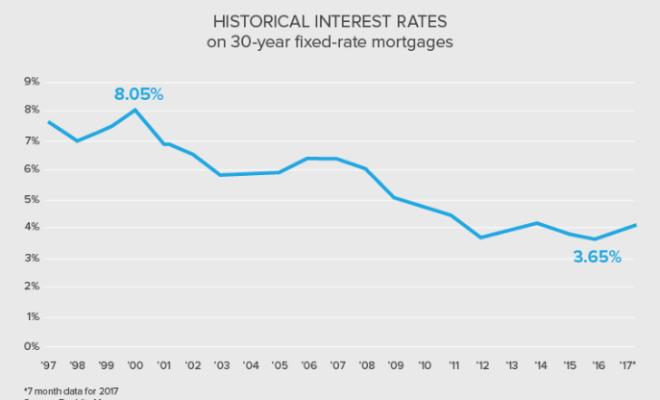

Before diving into comparisons, it’s vital to comprehend the various types of mortgage rates available. The two primary categories are fixed-rate mortgages and adjustable-rate mortgages (ARMs). A fixed-rate mortgage offers a constant interest rate throughout the entire loan term, while an adjustable-rate mortgage has a fluctuating interest rate that changes with market conditions. Each type has its pros and cons, depending on your financial goals and risk tolerance.

2. Research multiple lenders:

Banks, credit unions, and online lenders offer different mortgage rates to potential homeowners. As these institutions have distinct criteria for evaluating borrowers, their rates can vary significantly. To find the most attractive offers, take the time to research different lenders and collect quotes from several sources.

3. Compare Annual Percentage Rates (APRs):

Mortgage rates alone do not paint a complete picture of loan costs. To make an accurate comparison, consider evaluating the Annual Percentage Rate (APR), which incorporates both the interest rate as well as additional fees involved in securing a loan – such as points, underwriting fees or closing costs.

4. Look for discount points:

Discount points – generally paid upfront – allow borrowers to lower their interest rate by making an initial payment at closing. These points can often be negotiated with lenders and play a significant role in lowering your overall mortgage rate when compared to other available deals.

5. Assess loan terms:

Mortgage terms refer to the duration of repayment for your loan (typically divided into 15 and 30-year terms). Shorter loan terms usually have higher monthly payments but lower interest rates, while longer loan terms offer lower monthly payments but higher interest costs over time. Carefully weigh the pros and cons of each based on your unique financial circumstances.

6. Inquire about rate locks:

Once you’ve found a suitable mortgage rate, ask about locking it in for a specific period. Interest rates can fluctuate rapidly, and securing a rate lock can offer protection against sudden increases during the closing process.

7. Read the fine print:

Before committing to any mortgage, scrutinize all the conditions and clauses of your agreement. This will help you better understand the total cost of your mortgage and avoid surprises once you have signed the contract.

In conclusion, comparing mortgage rates from different lenders and considering factors such as APRs, discount points, loan terms, and rate locks are essential to finding the best possible deal for your home purchase. By investing time in research and understanding what you’re signing up for, you can save thousands over the life of your mortgage and confidently embark on this exciting new chapter of homeownership.