Best Veterans and Military Car Insurance

Introduction:

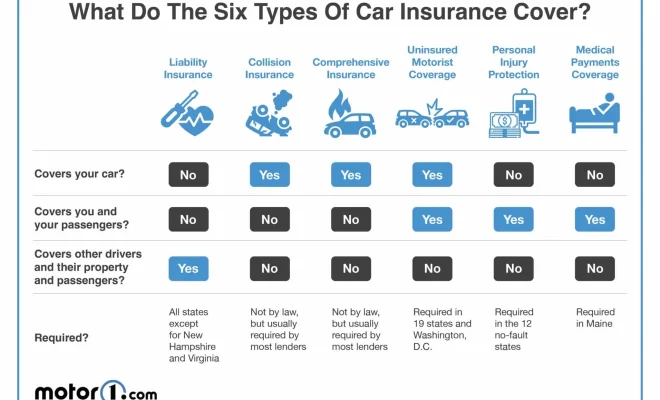

Insurance policies are a vital aspect of our everyday lives. They provide financial coverage in case of unforeseen accidents or incidents. For veterans and active-duty military personnel, choosing the right car insurance can be crucial due to their unique circumstances. In this article, we will explore some of the best car insurance options designed specifically for veterans and military personnel.

1) USAA:

The United Services Automobile Association (USAA) is the most popular choice for service members and veterans for their car insurance needs. USAA offers comprehensive coverage at competitive rates, which can be further reduced by taking advantage of the wide array of discounts they offer. Some of these discounts include safe driver, vehicle storage, family, and multi-policy discounts. USAA membership is only available to active-duty military personnel, veterans, and eligible family members.

2) Geico Military Insurance:

Geico has a dedicated military insurance program specifically designed for active-duty personnel and veterans. With Geico’s military discount, customers can save up to 15% on their car insurance premiums. This insurer also provides deployment discounts, allowing you to reduce your coverage if you are deployed overseas while still maintaining comprehensive protection for your vehicle. Geico’s emergency deployment discount may also help reduce costs during certain qualifying events.

3) Armed Forces Insurance (AFI):

Armed Forces Insurance is a more exclusive insurer solely focused on serving active-duty military members, veterans, and their families. AFI aims to provide personalized service tailored to the unique needs of its clients. As an added benefit for active-duty service members and their families, AFI offers automatic coverage extensions during duty-related changes in location or assignments.

4) Progressive Military Discount:

Progressive is another option that provides discounted car insurance rates for military personnel and veterans. They offer an easy-to-use online platform to manage your policy and make claims along with competitive rates and robust coverage options. Depending on your location and driving history, Progressive’s military discount can save you up to 15% on your car insurance premiums. They also offer specialized 24/7 customer service for military members.

5) State Farm:

State Farm is one of the largest insurance companies in the United States and offers a discount for active duty military personnel and veterans. With an extensive network of local agents, State Farm provides personalized service to cater to the unique needs of those who have served. Features such as accident forgiveness and Drive Safe & Save program can help lower premiums further.

Conclusion:

When choosing car insurance for veterans and active-duty military members, it’s essential to consider individual circumstances, location, and future plans. Companies like USAA, Geico, AFI, Progressive, and State Farm offer customized coverage with added benefits tailored specifically to accommodate the unique challenges faced by service members and their families. Explore these options thoroughly to find the right fit for your car insurance needs.