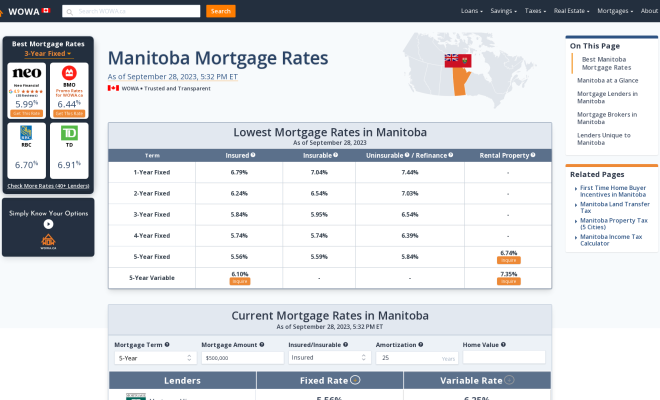

Best Mortgage Rates in Manitoba, Canada

In today’s competitive real estate market, finding the best mortgage rates in Manitoba, Canada is crucial for homebuyers who want to save money on their long-term investments. As one of Canada’s central provinces, Manitoba provides prospective homebuyers with diverse neighborhoods, vast natural attractions, and affordable housing options. Securing an advantageous mortgage rate can make the process even more enticing.

This article outlines the factors affecting mortgage rates in Manitoba and guides you through some top picks for the best mortgage rates currently available in the region.

Factors Affecting Mortgage Rates in Manitoba

1. Credit Score: Your credit score directly impacts the mortgage rates you’ll receive. A higher credit score signifies a lower risk for lenders, resulting in better mortgage rates.

2. Down Payment Amount: The size of your down payment affects your final mortgage rate due to the lender’s assessment of risk. Larger down payments typically result in lower interest rates.

3. Amortization Period: The length of your amortization period influences the amount of interest you pay over time. Shorter periods generally yield lower overall costs but may come at higher monthly payments.

4. Mortgage Type: Whether you choose a fixed or variable-rate mortgage will have a significant impact on your interest rate.

Conclusion:

Finding the best mortgage rate in Manitoba, Canada can seem like a daunting task, but with solid preparation and research, you can successfully navigate the process. Keep an eye on current mortgage trends, understand the factors affecting your individual rate, and implement the tips outlined above to secure the most favorable mortgage terms for your needs. By doing so, you’ll be one step closer to owning your dream home in Manitoba.